How to Create a Budget That Works for You

Nearly 78% of Americans live paycheck to paycheck, highlighting the importance of effective financial management. Learning how to create a budget is a crucial first step toward gaining control over your finances.

Mastering budgeting tips can be a game-changer for those struggling to make ends meet. By understanding how to allocate resources efficiently, individuals can break the cycle of financial stress and even explore opportunities like Passive income ideas to enhance their financial stability.

Learning to manage finances effectively is crucial for achieving financial stability. This involves tracking expenses and making informed decisions about savings and investments.

Table of Contents

Understanding the Purpose of a Budget

A budget is more than just a financial tool; it’s a roadmap to your financial goals. It helps you allocate resources effectively, ensuring that you make the most of your money.

What a Budget Really Is (and Isn’t)

A budget is often misunderstood as a restriction on spending. However, it’s a plan for how you want to allocate your money towards different expenses and savings. A good budget should be flexible and tailored to your financial goals.

It’s not about cutting down on everything you enjoy, but about making conscious decisions on how to use your money. Effective budgeting involves understanding your income and expenses and then making informed decisions, sometimes even exploring options like The best work-from-home jobs to boost your income.

The Benefits of Effective Budgeting

Budgeting has numerous benefits, including:

- Reduced financial stress

- Increased savings

- Better investment decisions

- A clear picture of your financial health

By adopting a budgeting method that works for you, you can achieve financial stability and security.

Common Budgeting Misconceptions

Many people believe that budgeting is too time-consuming or complicated. However, with the right tools and a bit of practice, it can become a straightforward part of your financial planning routine.

Another misconception is that budgets are rigid. In reality, a good budget is flexible and can be adjusted as your financial situation changes.

Assessing Your Current Financial Situation

Understanding your financial situation is the foundation upon which a successful budget is built. It involves taking a comprehensive look at your financial health to make informed decisions about your money.

Gathering Your Financial Documents

The first step in assessing your financial situation is to gather all relevant financial documents. This includes:

Bank Statements and Pay Stubs

Collect your recent bank statements and pay stubs to understand your income and expenses.

Credit Card Statements

Gather your credit card statements to track your spending and outstanding debts.

Calculating Your Total Income

To create an effective budget, you need to know your total income from all sources. This includes your salary, investments, and any side hustles.

Tracking Your Spending Patterns

Understanding where your money is going is crucial. This involves differentiating between:

Fixed vs. Variable Expenses

Fixed expenses remain the same every month, such as rent or mortgage payments, while variable expenses can change, like dining out or entertainment.

Needs vs. Wants

Distinguish between needs, which are essential expenses like housing and food, and wants, which are discretionary spending like vacations or hobbies.

By gathering your financial documents, calculating your total income, and understanding your spending patterns, you can get a clear picture of your financial situation. This assessment is crucial for making informed decisions about your money and creating a budget that works for you.

Identifying Your Financial Goals

Financial goals serve as the foundation of a successful budgeting strategy. By understanding what you want to achieve, you can create a tailored plan that meets your needs. Your financial goals can be categorized into short-term and long-term objectives.

Short-term vs. Long-term Goals

Short-term goals are typically achieved within a few months to a few years, such as saving for a vacation or paying off a small debt. Long-term goals, on the other hand, may take several years or even decades to accomplish, like buying a house or retirement planning. Understanding the difference between these two types of goals is crucial for effective financial planning.

Making Your Goals SMART

To ensure your financial goals are achievable, it’s essential to make them SMART: Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of saying “I want to save money,” a SMART goal would be “I will save $10,000 for a down payment on a house within the next two years.” This approach helps in creating a clear roadmap for your financial objectives.

Prioritizing What Matters Most

Not all financial goals are equally important. Prioritizing your goals ensures that you’re allocating your resources effectively. Start by listing your goals, then determine which ones are most critical to you. This process will help you stay focused on what’s truly important and make the necessary adjustments to your budgeting strategies—potentially using tools like Social media tools to support side hustles or online income streams.

Choosing the Right Budgeting Method for You

The key to successful budgeting lies in choosing a method that aligns with your financial goals and spending habits. With various budgeting methods available, it’s essential to understand the different approaches to manage your money effectively.

Several popular budgeting methods can help you achieve financial stability. Here are some of the most effective methods:

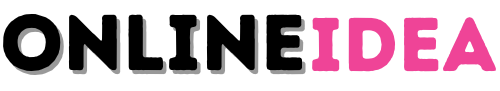

The 50/30/20 Budget Rule

The 50/30/20 budget rule is a straightforward approach to budgeting. It suggests allocating 50% of your income towards necessary expenses like rent and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment. This method is ideal for those who want a simple and easy-to-follow budgeting plan. You can learn more about this method from Investopedia’s guide on the 50/30/20 rule.

Zero-Based Budgeting

Zero-based budgeting involves allocating every dollar of your income towards a specific expense or savings goal. This method ensures that every dollar is accounted for and helps in reducing unnecessary expenses. It’s a great approach for those who want to have complete control over their finances.

Envelope System

The envelope system is a practical method for managing expenses. It involves dividing your expenses into categories and allocating a specific amount of cash for each category in an envelope. This visual approach helps in sticking to your budget and avoiding overspending.

Pay Yourself First Method

The pay yourself first method prioritizes savings by setting aside a portion of your income as soon as you receive it. This approach ensures that you save before spending on anything else, helping you build a safety net and achieve your long-term financial goals.

Values-Based Budgeting

Values-based budgeting involves aligning your budget with your personal values and priorities. This method helps in making conscious financial decisions that reflect what’s truly important to you, ensuring that your money is being used in a way that supports your lifestyle and goals.

By understanding and implementing these budgeting methods, you can develop an effective money management strategy that suits your needs and helps you achieve financial stability.

How to Create a Budget Step-by-Step

To manage your finances effectively, you need to Create a budget that works for you. This involves several key steps that help you understand your financial situation, make informed decisions, and achieve your financial goals.

Listing All Income Sources

The first step in creating a budget is to identify all your income sources. This includes:

- Salary or wages

- Investments

- Any side hustles or freelance work

Regular and Irregular Income

It’s essential to differentiate between regular and irregular income. Regular income is predictable and stable, such as a monthly salary. Irregular income, on the other hand, can vary from month to month, like freelance work or seasonal income. Understanding the nature of your income helps in planning your budget more effectively.

Categorizing Your Expenses

After listing your income, the next step is to categorize your expenses. This helps in understanding where your money is going and making necessary adjustments.

Essential Categories

Essential categories include:

- Housing

- Utilities

- Food

- Transportation

- Minimum debt payments

Discretionary Categories

Discretionary categories include:

- Entertainment

- Hobbies

- Travel

Distinguishing between essential and discretionary expenses is crucial for effective budgeting.

Allocating Funds to Each Category

Once you have categorized your expenses, allocate funds to each category based on your income and financial goals. Be sure to prioritize essential expenses over discretionary ones.

Building in Emergency Savings

A critical component of any budget is emergency savings. Aim to save a portion of your income regularly to build a safety net for unexpected expenses. This not only provides financial security but also reduces stress and helps you stay on track with your budget.

By following these steps and regularly reviewing your budget, you can create a budget that is tailored to your needs and helps you achieve financial stability.

Essential Categories to Include in Your Budget

To manage your finances effectively, it’s vital to identify the essential categories for your budget. A comprehensive budget is the backbone of personal finance management, enabling you to track your expenses, achieve financial stability, and work towards your long-term goals.

When constructing your budget, several key categories should be considered. These categories are fundamental to ensuring that you’re covering all necessary expenses and making progress on your financial objectives.

Housing and Utilities

One of the most significant expenses for most individuals is housing, which includes rent or mortgage payments, property taxes, and insurance. Utilities such as electricity, water, gas, and internet services are also essential. Allocating a substantial portion of your budget to these categories is crucial.

Food and Groceries

Another vital category is food and groceries. This includes not just groceries but also dining out and takeout expenses. Planning your food budget carefully can help you save money and reduce waste.

Transportation Costs

Whether you own a car or use public transportation, transportation costs can add up quickly. This category includes fuel, maintenance, insurance, and public transportation fees. Exploring cost-effective options, such as carpooling or using public transport, can be beneficial.

Debt Payments

For many, debt payments are a significant monthly expense. This includes credit card debt, student loans, personal loans, and mortgages. Prioritizing debt repayment is crucial for achieving financial freedom.

Savings and Investments

Savings and investments are critical components of a healthy budget. Allocating a portion of your income to savings and investment accounts helps build wealth over time and provides a safety net for unexpected expenses.

Healthcare and Insurance

Lastly, healthcare and insurance expenses should not be overlooked. This includes health insurance premiums, out-of-pocket medical expenses, and other related costs. Ensuring you have adequate insurance coverage is vital for protecting your financial well-being.

By including these essential categories in your budget, you’ll be better equipped to manage your finances, achieve your financial goals, and implement effective budgeting strategies. Regularly reviewing and adjusting your budget to reflect changes in your financial situation is also important.

- Identify your necessary expenses.

- Prioritize your spending based on your financial goals.

- Regularly review and adjust your budget.

Effective budgeting is a dynamic process that requires ongoing attention and adjustment. By focusing on these key categories and staying committed to your financial plan, you can achieve greater financial stability and success.

Tools and Resources for Budgeting

Effective budgeting requires the right tools and resources to help you manage your finances efficiently. With the numerous options available, you can choose the one that best fits your financial needs and preferences.

Budgeting Apps and Software

Budgeting apps and software have revolutionized the way we manage our finances. They offer a range of features, from tracking expenses to providing investment advice.

Free Options

Some popular free budgeting apps include Mint, Personal Capital, and YNAB (You Need a Budget) free trial. These apps offer basic features such as expense tracking and budgeting.

Paid Services

For more advanced features, consider paid budgeting services like Quicken or YNAB. These services offer additional tools such as investment tracking and financial planning.

Spreadsheet Templates

For those who prefer a more hands-on approach, spreadsheet templates can be a great option. Microsoft Excel and Google Sheets offer a variety of budgeting templates that can be customized to suit your needs.

Traditional Pen and Paper Methods

Some people still prefer traditional pen and paper methods for budgeting. This approach can be as simple as writing down your income and expenses in a notebook.

| Tool | Features | Cost |

|---|---|---|

| Mint | Expense tracking, budgeting | Free |

| YNAB | Budgeting, investment tracking | $6.99/month |

| Quicken | Financial planning, investment tracking | $3.99/month |

Implementing Your Budget in Daily Life

The key to successful budgeting lies in its daily implementation. To make your budget work for you, it’s essential to integrate it into your daily financial decisions.

Setting Up Automatic Payments

One effective way to ensure you stick to your budget is by setting up automatic payments for recurring expenses like rent, utilities, and credit card bills. This way, you’ll never miss a payment, and it helps in managing your cash flow more efficiently.

As David Bach, a well-known financial author, once said,

“Automating your finances is a game-changer. It makes saving and investing so easy that you’ll never have to think about it again.”

Creating Accountability Systems

Having someone to hold you accountable can significantly boost your budgeting success. This could be a financial advisor, a budgeting buddy, or even a family member who is also working on their budget.

Strategies for Sticking to Your Plan

Sticking to your budget requires discipline and the right strategies. Two effective methods include:

- Weekly check-ins to monitor your spending and stay on track.

- The cash envelope method, which involves allocating cash for specific expenses, helping you stick to your budget.

Weekly Check-ins

Regularly reviewing your budget helps you identify areas where you might be overspending and make necessary adjustments. It’s a simple yet effective way to stay on top of your finances.

Cash Envelope Method

The cash envelope method is a tangible way to manage your expenses. By dividing your expenses into categories and allocating a specific amount of cash for each, you can visually track your spending and avoid overspending.

Implementing these strategies can make a significant difference in your ability to stick to your budget and achieve your financial goals.

Dealing with Variable Income and Expenses

Dealing with irregular financial inflows and outflows requires a tailored budgeting approach. Individuals with variable income and expenses face unique challenges in managing their finances effectively.

Budgeting with an Irregular Income

When income is irregular, it’s crucial to prioritize essential expenses. This involves categorizing expenses into needs versus wants and allocating available funds accordingly. Creating a buffer for months with lower income can help maintain financial stability.

A practical strategy is to average income over a period, such as a year, to estimate monthly income more accurately. This helps in making a more realistic budget that can be adjusted as actual income varies.

Planning for Seasonal Expenses

Seasonal expenses, such as holiday spending or annual insurance premiums, can disrupt a budget if not planned for. Identifying and listing these expenses is the first step. Then, setting aside funds each month in a dedicated savings account can help distribute the cost more evenly throughout the year.

| Seasonal Expense | Annual Cost | Monthly Savings Needed |

|---|---|---|

| Holiday Spending | $1,200 | $100 |

| Insurance Premium | $600 | $50 |

Managing Unexpected Costs

Unexpected expenses are inevitable. Maintaining an emergency fund is crucial for managing such costs without derailing the budget. Aim to save 3-6 months’ worth of expenses in an easily accessible savings account.

By adopting these strategies, individuals can better navigate the challenges of variable income and expenses, ensuring a more stable financial foundation.

Adjusting Your Budget When Life Changes

Adjusting your budget to accommodate life changes is crucial for maintaining financial stability. Life events such as marriage, divorce, career changes, income fluctuations, and changes in family size can significantly impact your financial situation.

Major Life Transitions

Major life transitions often require significant adjustments to your budget. These transitions can include changes in marital status, career shifts, or other significant life events.

Marriage and Divorce

Marriage can bring about changes in income, expenses, and financial goals. It’s essential to combine financial planning with your partner, considering both short-term and long-term goals. On the other hand, divorce may necessitate dividing assets, adjusting to a single income, and re-establishing financial independence. Effective budgeting during these times involves reassessing your financial situation, adjusting your spending, and potentially redefining your financial goals.

Career Changes

Career changes, whether voluntary or involuntary, can impact your income and expenses. A new job might bring a higher salary but could also involve additional costs such as relocation expenses or professional attire. Conversely, a job loss requires immediate budget adjustments to accommodate reduced income. Budgeting during career transitions involves being adaptable and prepared for potential financial fluctuations.

Income Changes

Changes in income, whether an increase or decrease, require budget adjustments. An increase in income might allow for more savings or investment, while a decrease necessitates reducing expenses. Regularly reviewing your budget in response to income changes helps maintain financial stability.

Family Size Changes

Changes in family size, such as having children or children leaving the household, can significantly impact your budget. Additional family members may increase expenses for housing, food, education, and healthcare. Conversely, when children become independent, you may redirect those funds towards savings or other goals. Adjusting your budget to accommodate these changes is vital for maintaining financial health.

To effectively adjust your budget, consider the following key strategies:

- Regularly review your financial situation and budget.

- Be prepared to make adjustments as needed.

- Prioritize your financial goals.

- Use effective budgeting methods that suit your new circumstances.

By being proactive and flexible with your budget, you can navigate life’s changes with greater financial confidence.

Overcoming Common Budgeting Challenges

Effective budgeting is not just about making a plan, but also about overcoming the obstacles that come along the way. Many people face challenges when trying to stick to their budget, but being aware of these common pitfalls can help you navigate them successfully.

Consistently Overspending

One of the most common budgeting challenges is consistently overspending. This can be due to a lack of discipline, unexpected expenses, or simply not having a clear understanding of your spending habits. To overcome this, it’s essential to track your expenses closely and make adjustments to your budget as needed. Consider implementing the 50/30/20 rule, where 50% of your income goes towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Dealing with Budget Fatigue

Budget fatigue is another challenge that can cause individuals to give up on their budgeting efforts. This occurs when the process of managing finances becomes too tedious or restrictive. To combat budget fatigue, it’s crucial to make budgeting more manageable and less time-consuming. Automating savings and bill payments can help reduce the workload, while regularly reviewing and adjusting your budget can keep it relevant and effective.

Getting Back on Track After Setbacks

Setbacks are inevitable, but they don’t have to derail your entire budgeting effort. If you find yourself off track, don’t be too hard on yourself. Instead, identify the cause of the setback and make a plan to get back on course. This might involve adjusting your budget categories, cutting back on non-essential expenses, or finding ways to increase your income.

Handling Financial Emergencies

Financial emergencies, such as car repairs or medical bills, can significantly impact your budget. Having an emergency fund in place can provide a cushion against these unexpected expenses. If you don’t have one, consider allocating a portion of your budget towards building up this fund. Effective money management involves being prepared for the unexpected.

Measuring Your Budgeting Success

Measuring the success of your budget is crucial to understanding its impact on your financial health. A well-crafted budget is not just about tracking expenses; it’s about achieving your financial goals. To determine whether your budget is working for you, you need to monitor key financial indicators.

Key Financial Indicators to Track

Tracking the right financial indicators is essential to understanding your budget’s effectiveness. Two crucial indicators are debt reduction and savings growth.

Debt Reduction

Reducing debt is a significant milestone in financial planning. By paying off high-interest loans and credit cards, you can free up more money in your budget for savings and investments. For instance, consider the story of Jane, who paid off her $10,000 credit card debt in two years by allocating an extra $417 monthly.

“The debt snowball method was a game-changer for me. I paid off my smallest debt first, and it gave me the momentum to tackle the bigger ones,” Jane said.

Savings Growth

Growing your savings is another vital indicator of budgeting success. It’s essential to build an emergency fund and save for long-term goals, such as retirement or a down payment on a house. As Warren Buffett once said, “Do not save what is left after spending, but spend what is left after saving.”

| Indicator | Target | Current Status |

|---|---|---|

| Debt Reduction | $10,000 | $5,000 |

| Savings Growth | $20,000 | $8,000 |

Celebrating Milestones

Celebrating your financial milestones is crucial for staying motivated. Whether it’s paying off a loan or reaching a savings goal, acknowledging your achievements can help you stay on track. For example, you could treat yourself to a nice dinner or a weekend getaway after reaching a savings milestone.

Refining Your System Over Time

Budgeting is not a one-time task; it requires continuous refinement. As your financial situation changes, you may need to adjust your budget to stay on track. Regularly reviewing your budget and making adjustments as needed is key to long-term financial success. By doing so, you can ensure that your budget remains aligned with your financial goals.

Conclusion

By understanding the purpose of a budget, assessing your financial situation, and choosing the right budgeting method, you can take control of your personal finance. Effective budgeting is not about depriving yourself of things you enjoy, but about making conscious financial decisions that align with your goals.

To create a budget that truly works for you, it’s essential to be realistic, flexible, and patient. Start by implementing the steps outlined in this article, and don’t be afraid to adjust your approach as needed. With time and practice, you’ll become more confident in your ability to manage your finances and achieve your financial objectives.

By taking the first step towards creating a budget, you’re investing in your financial future. Stay committed, and you’ll be on your way to achieving financial stability and security. Effective personal finance management is within your reach when you create a budget that works for you.

FAQ

What is the 50/30/20 budget rule?

The 50/30/20 budget rule is a simple way to allocate your income towards different categories. It suggests that 50% of your income should go towards necessary expenses like housing and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

How do I start creating a budget?

To start creating a budget, begin by gathering your financial documents, such as bank statements and pay stubs. Then, calculate your total income and track your spending patterns to understand where your money is going.

What are some common budgeting mistakes to avoid?

Common budgeting mistakes include not accounting for irregular expenses, not prioritizing needs over wants, and not regularly reviewing and adjusting your budget. Using budgeting apps like Mint or Personal Capital can help you stay on track.

How often should I review my budget?

It’s a good idea to review your budget regularly, such as every few months, to ensure you’re on track with your financial goals. You can also use budgeting software like Quicken or YNAB (You Need a Budget) to help you stay organized.

What are some strategies for sticking to my budget?

Strategies for sticking to your budget include setting up automatic payments, creating accountability systems, and using the cash envelope method for discretionary spending. You can also try implementing a “30-day rule” where you wait 30 days before making non-essential purchases.

How do I budget for irregular income or expenses?

To budget for irregular income or expenses, consider setting aside funds in a separate savings account to cover periodic expenses, such as car maintenance or property taxes. You can also use a budgeting app like Wave or Zoho Books to help you track your income and expenses.

What are some essential categories to include in my budget?

Essential categories to include in your budget are housing, food, transportation, debt payments, savings, and healthcare. You should also consider budgeting for emergency funds and retirement savings.

How can I make my budget more flexible?

To make your budget more flexible, consider using a zero-based budgeting approach, where you allocate every dollar towards a specific category. You can also prioritize your spending based on your financial goals and adjust your budget accordingly.