Envelope Budgeting System: Why It’s Perfect for Beginners

Managing personal finances effectively is a challenge many face. A budgeting strategy that has gained popularity for its simplicity and effectiveness is the envelope budgeting system. Zero-based budgeting is another approach that aligns closely with the principles of the envelope budgeting system, helping individuals gain full control of their financial situation.

This method involves dividing expenses into categories and allocating cash to labeled envelopes for each category, helping individuals stick to their financial plans and avoid overspending.

By adopting this hands-on approach to financial planning, individuals can better manage their expenses and achieve financial stability.

Table of Contents

What Is the Envelope Budgeting System?

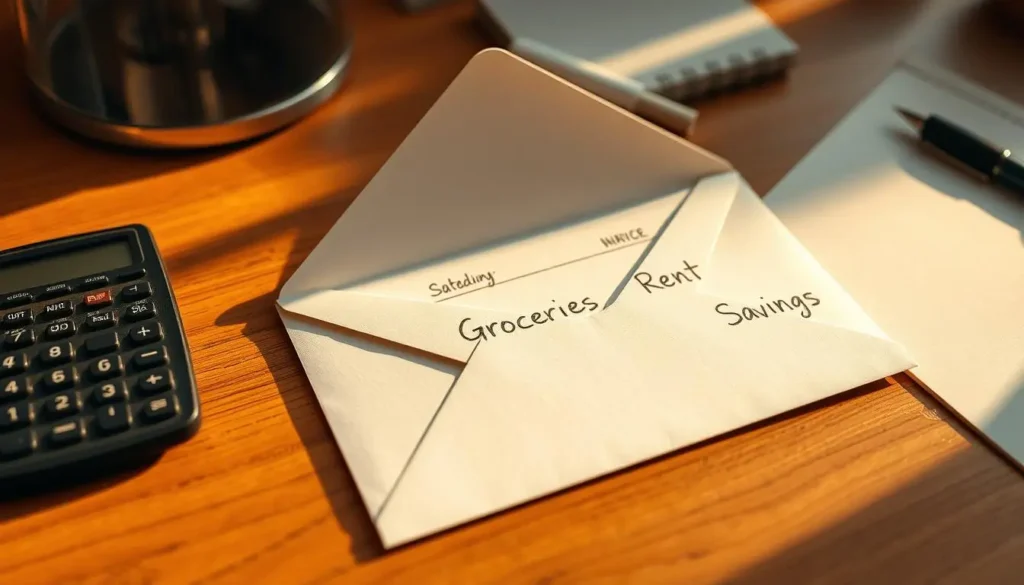

At its core, the envelope budgeting system is about allocating cash into separate envelopes for different expense categories, making it a straightforward method for cost management and expense tracking.

The Core Concept of Cash Allocation

The envelope system works by dividing expenses into categories (such as groceries, entertainment, and utilities) and allocating a specific amount of cash to each category. This physical allocation of money helps in money management by making individuals more aware of their spending. For a similar approach that helps manage finances, consider zero-based budgeting, where every dollar is assigned a job to ensure efficient financial planning.

- Identify expense categories

- Allocate cash to each category

- Use the allocated cash for expenses

Historical Background of Envelope Budgeting

The envelope budgeting system has its roots in traditional cash-based budgeting practices.

Origins of Cash-Based Budgeting

Historically, people managed their finances using cash, which naturally limited spending to the amount available. This method was effective for expense tracking and preventing overspending.

Evolution to Modern Practice

Over time, the envelope system has evolved to accommodate modern financial needs, including digital adaptations that still maintain the core principle of categorizing and limiting expenses.

By using the envelope budgeting system, individuals can achieve better control over their finances, making it a valuable tool for money management. The system’s simplicity and effectiveness in cost management make it a popular choice for those seeking to improve their financial discipline.

Why the Envelope Budgeting System Works

By utilizing physical cash, the envelope budgeting system taps into psychological triggers that promote fiscal responsibility and effective budget allocation. This system is designed to help individuals manage their finances more effectively by leveraging the tangible nature of cash. For an alternative method that also provides a detailed overview of expenses, consider zero-based budgeting, which assigns every dollar a specific purpose for more effective financial planning.

Psychological Benefits of Physical Cash

Using physical cash for budgeting has several psychological benefits. It creates a tangible connection between the individual and their money, making the act of spending more impactful. Studies have shown that people tend to feel more connected to their money when they use cash, as opposed to digital transactions.

Immediate Spending Awareness

The envelope system provides immediate spending awareness by making it clear when money is being spent. As cash is used, individuals can see their budget dwindling, which helps to curb unnecessary expenses. This immediate feedback loop is crucial in maintaining fiscal discipline.

The Power of Visual Budget Management

A key advantage of the envelope budgeting system is its visual representation of budget allocation. By dividing expenses into categories and allocating cash accordingly, individuals can visually track their spending. This visual management helps in making informed financial decisions and staying within budget. If you’re looking for another budgeting approach that offers similar control over your finances, check out zero-based budgeting, which allocates every dollar to a specific purpose.

Some of the key benefits of the envelope budgeting system include:

- Enhanced fiscal responsibility through physical cash usage

- Improved spending awareness due to tangible transactions

- Effective visual management of budget allocation

Benefits of Using an Envelope Budgeting System

Utilizing an envelope budgeting system can lead to better financial awareness and control. This simple yet effective budgeting strategy helps individuals manage their finances more efficiently by categorizing expenses and limiting spending.

Preventing Overspending

One of the primary advantages of the envelope system is its ability to prevent overspending. By allocating a specific amount of cash for discretionary categories, individuals can avoid exceeding their budget. This physical limitation on spending helps curb impulse purchases and promotes more mindful consumption.

Eliminating Credit Card Debt

The envelope budgeting system can also be instrumental in eliminating credit card debt. By dedicating an envelope to debt repayment, individuals can systematically reduce their outstanding balances. This focused approach helps in making consistent progress towards becoming debt-free.

Creating Financial Awareness

Implementing an envelope budgeting system fosters financial awareness by requiring individuals to track their expenses closely. This heightened awareness is crucial for making informed financial decisions.

Recognizing Spending Patterns

Through the envelope system, individuals can gain insights into their spending patterns. By regularly monitoring the amounts spent from each envelope, one can identify trends and areas where adjustments are needed.

Identifying Budget Leaks

The detailed tracking involved in envelope budgeting helps in identifying budget leaks or areas where money is being unnecessarily spent. This allows for timely interventions to rectify these leaks and optimize the budget.

Envelope Budgeting vs. Other Budgeting Methods

Effective financial planning involves choosing the right budgeting method, with several options available. The envelope budgeting system is one of many approaches to managing finances, each with its unique benefits and drawbacks. For more budgeting methods and tips, visit our budgeting tips page.

Comparison with Zero-Based Budgeting

Zero-based budgeting requires allocating every dollar towards a specific expense or savings, leaving no unallocated funds. In contrast, the envelope system focuses on categorizing expenses and allocating cash accordingly. While both methods promote financial discipline, the envelope system provides a tangible, visual representation of one’s budget.

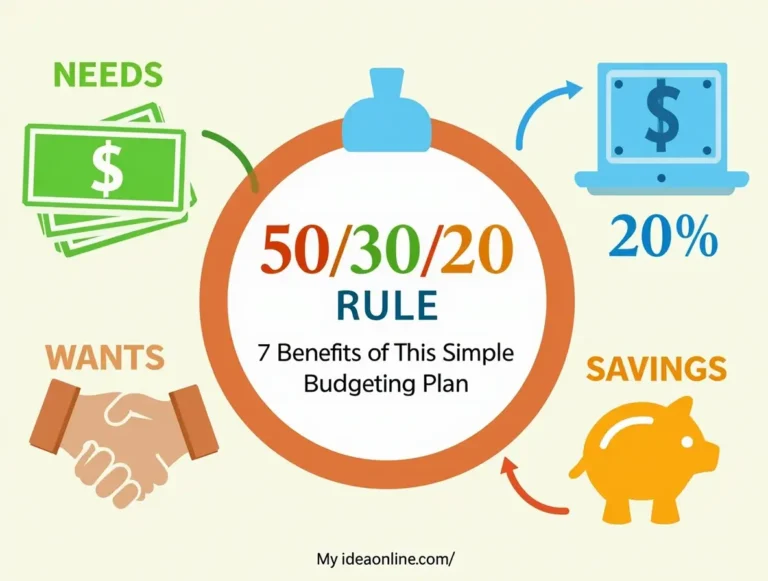

Differences from 50/30/20 Budgeting

The 50/30/20 rule allocates 50% of income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment. The envelope system, however, allows for more flexibility by creating categories based on individual needs. This flexibility can be particularly beneficial for those with irregular expenses or unique financial obligations. To learn more about budgeting strategies, visit our budgeting tips page.

Digital vs. Physical Envelope Systems

While traditional envelope budgeting relies on physical cash and envelopes, digital envelope systems utilize apps and online tools to replicate this method. The choice between digital and physical systems depends on personal preference and financial habits. Some may prefer the tangibility of cash, while others may appreciate the convenience and automation offered by digital tools. For more insights on budgeting methods, check out our budgeting tips page.

Getting Started: Setting Up Your Envelope System

Envelope budgeting is a hands-on approach to money management that starts with a thorough analysis of your income and expenditures. By understanding where your money is coming from and where it’s going, you can effectively manage your finances.

Step 1: Analyzing Your Income and Expenses

The first step in setting up your envelope system is to analyze your income and expenses. This involves calculating your total monthly income and listing all your fixed and variable expenses.

Calculating Monthly Income

To start, calculate your total monthly income from all sources, including your salary, investments, and any side hustles. This will give you a clear picture of how much money you have available for budgeting.

Listing Fixed and Variable Expenses

Next, list all your fixed expenses, such as rent, utilities, and insurance, as well as your variable expenses, like groceries, entertainment, and travel. This will help you understand where your money is going and identify areas where you can cut back.

Step 2: Creating Budget Categories

Once you have a clear picture of your income and expenses, the next step is to create budget categories that align with your spending habits.

Essential Categories to Include

Typical categories include housing, transportation, food, entertainment, and savings. You can also create categories for irregular expenses, such as car maintenance or property taxes.

Personalizing Categories for Your Lifestyle

Personalize your categories to fit your lifestyle and financial goals. For example, if you’re an avid reader, you might have a category for books or magazine subscriptions.

Step 3: Preparing Your Physical Envelopes

With your categories in place, it’s time to prepare your physical envelopes.

Materials Needed

You’ll need a set of envelopes, a marker or pen, and possibly some labels or stickers to help organize them. You can also use a cash box or a designated spot to store your envelopes.

Organization Systems

Organize your envelopes in a way that makes sense to you, such as alphabetically or by priority. You can also use a binder or folder to keep track of your budget categories and expenses.

By following these steps, you can set up an effective envelope budgeting system that helps you track your expenses and manage your money more efficiently.

How to Allocate Money to Your Envelopes

Once you’ve set up your envelope system, the next step is to allocate your money wisely. Allocating funds effectively to different envelopes is crucial for maintaining fiscal responsibility and achieving your financial goals.

Determining Category Priorities

To allocate your money effectively, you need to determine your category priorities. Start by identifying your essential expenses, such as rent/mortgage, utilities, and groceries. These categories should be your top priority. Then, allocate funds to less critical categories like entertainment and hobbies.

Cash Withdrawal and Distribution Strategy

Decide on a cash withdrawal and distribution strategy that works for you. One common approach is to withdraw your total allocated cash at the beginning of the month and distribute it among your envelopes. You can also choose to withdraw cash as needed, though this may require more frequent bank visits. For more detailed budgeting strategies, visit our budgeting tips page.

Adjusting Allocations Based on Monthly Variations

Your income and expenses can vary from month to month. Be prepared to adjust your allocations accordingly. For instance, if you have a month with extra expenses, you may need to reduce spending in other categories to compensate.

Handling Irregular Expenses

Irregular expenses, such as car maintenance or property taxes, can be challenging to manage. One strategy is to set aside a small amount each month in a dedicated envelope for these expenses. This way, when an irregular expense arises, you’ll have funds available.

| Expense Category | Monthly Allocation | Irregular Expense Fund |

|---|---|---|

| Groceries | $500 | $20 |

| Entertainment | $200 | $10 |

| Utilities | $150 | $5 |

By following these steps and regularly reviewing your budget allocations, you can maintain a robust envelope budgeting system that supports your financial health and fiscal responsibility.

Managing Digital Expenses in an Envelope Budgeting System

Managing digital expenses within an envelope budgeting framework requires a hybrid approach that combines physical and digital financial management techniques. As our financial lives become increasingly intertwined with digital transactions, it’s essential to adapt the traditional envelope system to accommodate online expenses effectively.

Adapting for Online Bills and Subscriptions

To manage digital expenses, start by identifying recurring online bills and subscriptions. These can include streaming services, software subscriptions, and online utility payments. Allocate a specific envelope for these expenses, just as you would for physical expenses, to keep track of your digital outgoings.

Digital Envelope Apps and Tools

Several digital tools and apps can help you manage your envelope budgeting system more effectively, especially when it comes to digital expenses. These tools offer features that mimic the physical envelope system, allowing you to create digital envelopes for different expense categories.

Popular Budgeting Apps

Some popular budgeting apps that support envelope budgeting include:

- Mint

- You Need a Budget (YNAB)

- Envelope Budgeting App

- Goodbudget

Digital Envelope Features to Look For

When selecting a digital envelope app, look for features such as:

- Customizable budget categories

- Automatic expense tracking

- Alerts for overspending

- Integration with your bank accounts

| Feature | Mint | YNAB | Goodbudget |

|---|---|---|---|

| Customizable Categories | Yes | Yes | Yes |

| Automatic Expense Tracking | Yes | Yes | No |

| Overspending Alerts | Yes | Yes | Yes |

Tracking Digital Spending Effectively

To track digital spending effectively, regularly review your digital transactions against your budget categories. Many digital envelope apps can sync with your bank accounts and credit cards, making it easier to monitor your expenses in real-time.

By combining the tactile benefits of the physical envelope system with the convenience and automation of digital tools, you can achieve a more comprehensive and flexible budgeting approach.

Common Challenges and How to Overcome Them

Implementing an envelope budgeting system can be a game-changer for managing finances, but it’s not without its challenges. As users navigate this system, they may encounter several common obstacles that require practical solutions.

When You Run Out of Money in an Envelope

One of the most common challenges is running out of money in a specific envelope. This can happen due to underestimating expenses or unexpected costs. To address this, it’s essential to review your budget categories and adjust your allocations accordingly.

For instance, if you consistently run out of money in your grocery envelope, consider reducing allocations in other categories or finding ways to reduce grocery expenses.

Handling Emergency Expenses

Emergency expenses can significantly disrupt an envelope budgeting system. Having a plan in place for such situations is crucial.

Creating an Emergency Fund Envelope

One effective strategy is to create an emergency fund envelope. Allocate a small portion of your income to this envelope each month to build up a reserve for unexpected expenses.

Rules for Borrowing Between Envelopes

Another approach is to establish rules for borrowing between envelopes. For example, you might allow borrowing from a savings envelope or a less critical category, with the condition that you repay the borrowed amount in the next budgeting period.

| Envelope Category | Allocated Amount | Emergency Borrowing Allowed |

|---|---|---|

| Groceries | $500 | No |

| Entertainment | $200 | Yes |

| Emergency Fund | $1000 | N/A |

Adjusting Your System Over Time

As your financial situation changes, your envelope budgeting system may need adjustments. Regularly review your budget categories and allocations to ensure they remain aligned with your financial goals.

Getting Family Members on Board

Involving family members in the envelope budgeting process is crucial for its success. Educate them on the importance of budgeting and the role they play in maintaining the system.

By working together and maintaining open communication, you can overcome the challenges associated with the envelope budgeting system and achieve your financial objectives.

Success Stories: Real-Life Envelope Budgeting Transformations

Countless individuals have found financial freedom using the envelope budgeting method. This simple yet effective system has helped people from all walks of life achieve significant financial transformations.

Debt Elimination Through Envelope Budgeting

Many have successfully used the envelope system to eliminate debt. By allocating specific amounts for debt repayment, individuals can focus on paying off their debts without overspending in other areas. For instance, a study on zero-based budgeting – a method closely related to envelope budgeting – showed that individuals who adopted this approach were more likely to pay off their debts.

Building Savings with the Envelope Method

The envelope system isn’t just for expense management; it’s also a powerful tool for building savings. By creating an envelope specifically for savings, individuals can ensure that they set aside a fixed amount regularly. This method has helped many achieve their savings goals, whether it’s for a down payment on a house, a vacation, or an emergency fund.

Family Budgeting Success Stories

Envelope budgeting has also been effective for families. By involving all family members in the budgeting process and allocating funds into different envelopes for various expenses, families can better manage their finances and work towards common financial goals. This approach promotes transparency and cooperation, making it easier to stick to the budget.

Small Business Applications

The principles of envelope budgeting can also be applied to small businesses for effective cost management. By categorizing expenses into different envelopes, business owners can better track their spending and make informed decisions about resource allocation. This can lead to improved financial health and profitability for the business.

In conclusion, the envelope budgeting system has proven to be a versatile and effective tool for achieving financial stability and success, applicable to individuals, families, and small businesses alike.

Conclusion: Taking Control of Your Finances with Envelope Budgeting

Implementing an envelope budgeting system is a straightforward yet effective way to manage your finances and achieve fiscal responsibility. By allocating cash into separate envelopes for different expenses, individuals can visually track their spending and make conscious financial decisions. This system promotes financial planning by categorizing expenses and prioritizing needs over wants.

The envelope budgeting system has been shown to help eliminate credit card debt and prevent overspending. By using physical cash, individuals are more aware of their spending habits, leading to greater financial awareness and control. As seen in various success stories, this method can lead to significant improvements in financial stability and peace of mind.

By adopting the envelope budgeting system, individuals can take a proactive approach to financial planning, ensuring they are on the path to achieving their financial goals. This simple, hands-on method empowers users to manage their finances effectively, fostering a culture of fiscal responsibility.

FAQ

What is the envelope budgeting system, and how does it work?

The envelope budgeting system is a simple, effective method for managing finances by dividing expenses into categories and allocating cash to labeled envelopes for each category. This hands-on approach helps individuals stick to their budget and avoid overspending.

How does the envelope budgeting system help with cost management and expense tracking?

By allocating specific amounts of cash to different categories, individuals can better manage their expenses and track their spending, making it easier to stay within budget and achieve fiscal responsibility.

Can the envelope budgeting system be used in conjunction with digital budgeting tools?

Yes, the envelope budgeting system can be adapted for digital use through various budgeting apps and tools that mimic the envelope system, allowing for a hybrid approach that combines physical and digital budgeting methods.

How do I handle irregular expenses, such as car maintenance or property taxes, in an envelope budgeting system?

To manage irregular expenses, you can set aside a specific amount each month in a designated envelope or account, ensuring that you’re prepared for these expenses when they arise.

What are some common challenges faced when using an envelope budgeting system, and how can they be overcome?

Common challenges include running out of money in a particular envelope or handling emergency expenses. Solutions include creating an emergency fund envelope and establishing rules for borrowing between envelopes.

How can I involve my family members in the envelope budgeting process?

To get your family members on board, you can educate them on the benefits of the envelope budgeting system, involve them in the budgeting process, and ensure that everyone is aware of their roles and responsibilities in managing the household finances.

Can the envelope budgeting system be used for zero-based budgeting?

Yes, the envelope budgeting system can be used in conjunction with zero-based budgeting principles, where every dollar is allocated to a specific category, ensuring that your income minus expenses equals zero.

How often should I review and adjust my envelope budgeting system?

It’s essential to regularly review your budget and adjust your envelope allocations as needed to accommodate changes in income, expenses, or financial goals, ensuring that your budgeting strategy remains effective and aligned with your financial objectives.