Budgeting Tips: 7 Powerful Secrets Every Beginner Should Know

Many face the challenge of managing finances effectively, especially when resources are limited. Nearly 40% of Americans don’t have enough savings to cover a $400 emergency expense, highlighting the importance of effective financial management. In this article, we’ll share essential budgeting tips to help you manage your finances better and build a more secure financial future.

Creating a viable financial plan is crucial, even with a limited income. This article will guide you through budgeting on a low income, providing practical tips and strategies to help you manage your finances effectively. For a simple yet effective method, check out the 50/30/20 rule to help structure your budget.

Table of Contents

The Reality of Financial Management with Limited Resources

Financial management for low-income earners is not just about cutting expenses, but also about making smart financial decisions. Living on a limited budget means that every dollar counts, and understanding how to allocate resources effectively is crucial. For helpful tips on managing money wisely, check out this Guide on financial literacy from the Consumer Financial Protection Bureau.

Common Financial Challenges for Low-Income Earners

Low-income individuals often face specific financial challenges that can be overwhelming. Two of the most significant hurdles are living paycheck to paycheck and dealing with unexpected expenses. With the right budgeting tips, individuals can manage these challenges more effectively and build a stable financial foundation.

Paycheck-to-Paycheck Living

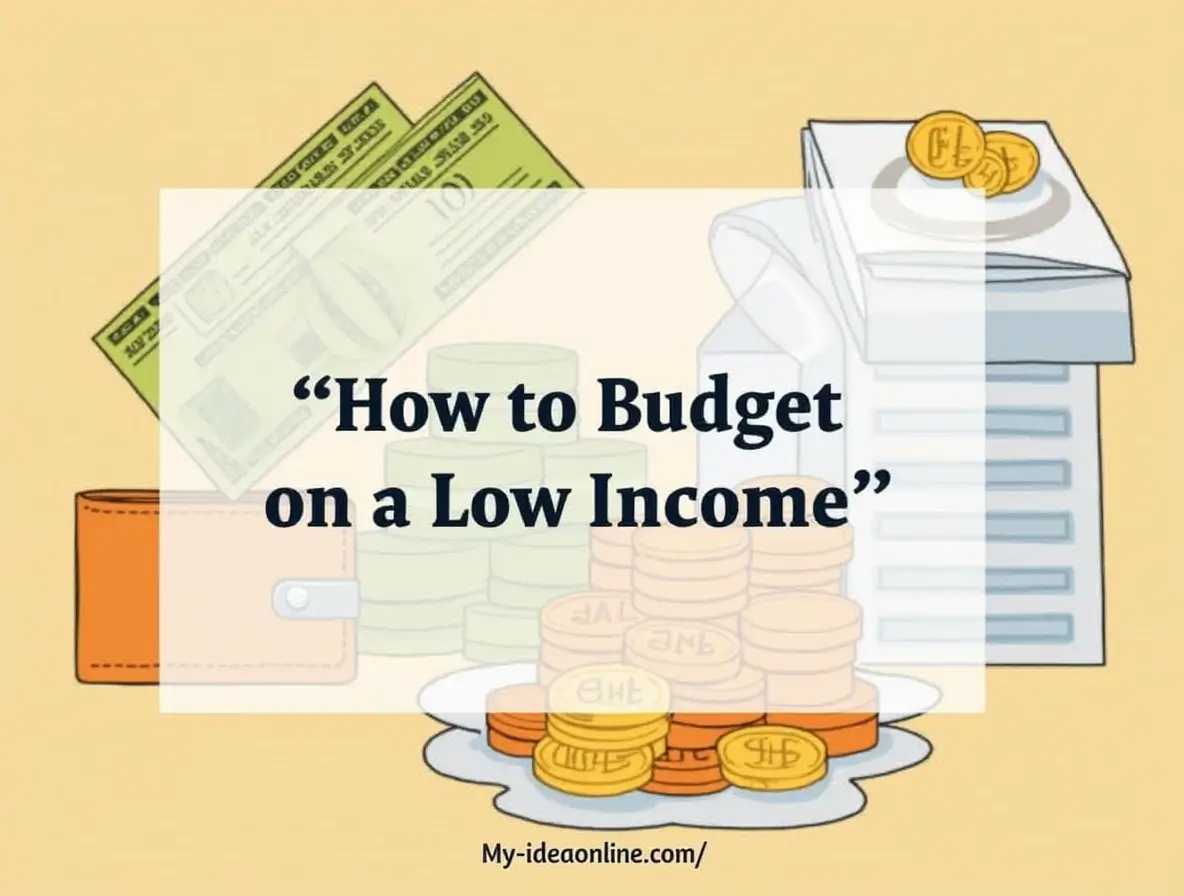

Living paycheck to paycheck means that a significant portion of the population is just managing to cover their expenses with their income, leaving little to no room for savings or unexpected expenses. This can lead to a cycle of debt and financial instability. To help break this cycle, consider applying the 50/30/20 rule to create a more balanced and sustainable budget.

Unexpected Expenses

Unexpected expenses, such as car repairs or medical bills, can derail even the most carefully planned budget. Without an emergency fund, these expenses can lead to further financial strain.

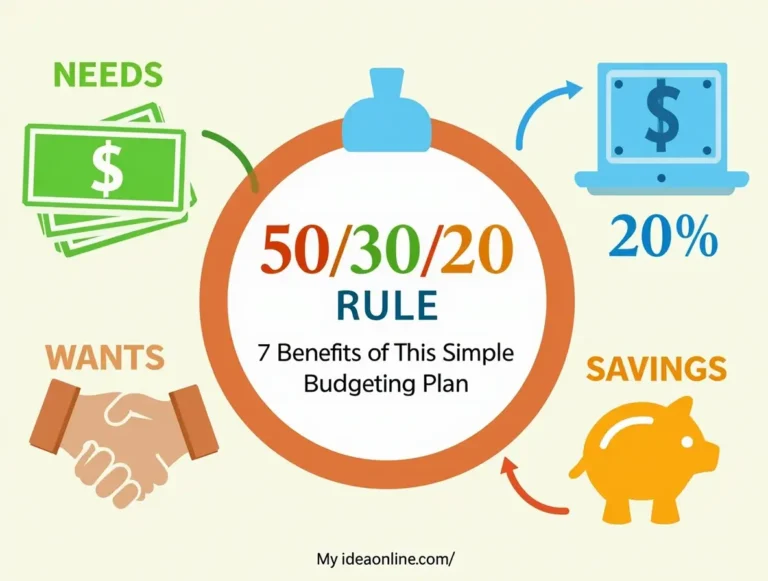

The Psychological Impact of Financial Stress

Financial stress can have a profound impact on mental health, leading to anxiety, depression, and a reduced quality of life. The constant pressure of managing limited finances can be overwhelming.

Financial Stress Impact

| Aspect | Effect |

|---|---|

| Mental Health | Anxiety, Depression |

| Relationships | Strain on Family and Friends |

| Physical Health | Increased Blood Pressure, Other Health Issues |

Understanding these challenges is the first step towards managing them. By acknowledging the psychological impact of financial stress and the common financial challenges faced by low-income earners, individuals can begin to develop strategies to improve their financial stability. For example, avoiding common pitfalls outlined in our guide on 10 budgeting mistakes can be a game-changer in building better financial habits.

Assessing Your Current Financial Situation

Understanding your current financial situation is crucial for effective budgeting on a low income. It involves a thorough examination of your income sources, expenses, and overall financial health. By using budgeting tips, you can gain a clearer picture of where your money is going and make informed decisions to improve your financial stability.

Tracking All Income Sources

To start, it’s essential to track all your income sources. This includes:

Regular Employment Income

For those with a steady job, this involves noting down your regular salary or wages. It’s the primary source of income for many and serves as the foundation for your budget.

Irregular or Seasonal Income

For individuals with irregular income, such as freelancers or those in seasonal employment, it’s crucial to average your income over a period to understand your monthly financial standing. Using budgeting tips for irregular income can help you manage fluctuations and plan ahead for lean months.

Identifying and Categorizing Expenses

Next, identify and categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies). This step helps in prioritizing your spending.

For instance, a simple categorization could be:

- Essential expenses: rent, utilities, groceries

- Non-essential expenses: dining out, entertainment

Calculating Your Financial Baseline

After tracking income and expenses, calculate your financial baseline by subtracting total expenses from total income. This will indicate whether you’re operating at a surplus, deficit, or break-even.

For example, if your monthly income is $2,000 and your expenses are $1,800, you have a surplus of $200.

| Category | Monthly Amount |

|---|---|

| Income | $2,000 |

| Essential Expenses | $1,500 |

| Non-Essential Expenses | $300 |

| Surplus/Deficit | $200 |

As financial expert Dave Ramsey once said, “A budget is telling your money where to go instead of wondering where it went.” This emphasizes the importance of having a clear financial plan.

“The key to financial freedom is not how much you make, but how much you save and invest.”

Robert Kiyosaki

Setting Realistic Financial Goals on Limited Income

Setting realistic financial goals is a pivotal step in effectively managing money on a low income. It involves understanding your financial situation and aligning your objectives with your current resources.

Short-Term vs. Long-Term Goals

Distinguishing between short-term and long-term financial goals is essential. Short-term goals might include saving for an emergency fund or paying off immediate debts, while long-term goals could involve saving for a major purchase or retirement. To help manage both effectively, consider using the 50/30/20 rule as a budgeting framework that aligns spending with your goals.

Prioritizing Essential Needs

Prioritizing essential needs over discretionary spending is crucial when managing finances on a limited income. Essential needs include housing, food, healthcare, and minimum debt payments.

Creating SMART Financial Objectives

Creating SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial objectives helps in making financial goals clear and actionable. For instance, instead of saying “I want to save money,” a SMART goal would be “I will save $500 in the next 6 months.”

Specific Goals for Different Income Levels

Financial goals can vary significantly based on income levels. For example:

- For those earning below the poverty line, goals might focus on meeting basic needs.

- For low-income earners slightly above the poverty line, goals could include building a small emergency fund.

- For those with a bit more financial flexibility, goals might expand to include saving for specific expenses or long-term investments.

By setting realistic financial goals tailored to your income level, you can create a roadmap for financial stability and progress.

How to Budget on a Low Income: Core Principles

Effective budgeting is crucial for individuals with low incomes to achieve financial stability. By applying core budgeting principles, individuals can better manage their limited financial resources.

The 50/30/20 Rule Adapted for Lower Incomes

The 50/30/20 rule is a popular budgeting guideline that suggests allocating 50% of one’s income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. For low-income individuals, adapting this rule might mean adjusting the proportions to accommodate essential expenses that may consume a larger portion of their income.

Zero-Based Budgeting Method

Zero-based budgeting involves allocating every dollar of income towards a specific expense or savings goal, ensuring that every dollar is accounted for. This method is particularly useful for low-income budgeting as it helps in prioritizing expenses.

Envelope System for Cash Management

The envelope system is a simple cash management technique where expenses are categorized, and funds are allocated to labeled envelopes for each category. This visual system helps in sticking to the budget.

Digital Alternatives to Physical Envelopes

For those who prefer not to use cash, digital envelope systems can be created using budgeting apps that mimic the envelope system virtually, providing a convenient alternative.

| Budgeting Method | Description | Benefit for Low-Income |

|---|---|---|

| 50/30/20 Rule | Allocate 50% to necessities, 30% to discretionary spending, and 20% to savings and debt | Helps in prioritizing essential expenses |

| Zero-Based Budgeting | Allocate every dollar towards a specific expense or savings | Ensures every dollar is utilized effectively |

| Envelope System | Categorize expenses and allocate funds to labeled envelopes | Visual and straightforward cash management |

By understanding and applying these core budgeting principles, individuals on a low income can better navigate their financial challenges and work towards achieving financial stability.

Essential Strategies to Reduce Expenses

One of the key challenges of budgeting on a low income is identifying areas where expenses can be reduced. Effective expense reduction is crucial for managing finances efficiently and achieving financial stability.

Housing Cost Reduction Techniques

Reducing housing costs can significantly impact your overall budget. Consider negotiating your rent or exploring more affordable housing options. Another strategy is to downsize your living space or find a roommate to split the costs.

Minimizing Food Expenses Without Sacrificing Nutrition

To minimize food expenses, plan your meals and make a shopping list to avoid impulse buys. Buying in bulk and preparing meals at home can also help. Consider using coupons or shopping at discount grocery stores. For more money-saving strategies at the grocery store, check out this guide to saving on groceries.

Reducing Utility Bills and Household Costs

Simple actions like switching to energy-efficient lighting and reducing water usage can lower utility bills. Regular maintenance of household appliances can also prevent costly repairs. These practical budgeting tips can help you save on everyday expenses and improve your overall financial health.

Transportation Cost-Cutting Measures

For transportation, consider carpooling or using public transport. Regular maintenance of your vehicle, such as oil changes and tire checks, can also help reduce long-term costs.

By implementing these strategies, individuals on a low income can significantly reduce their expenses, making it easier to manage their budget and achieve financial goals.

Maximizing Every Dollar in Your Budget

Effective budgeting on a low income involves more than just cutting expenses; it’s about maximizing the value of every dollar spent. To achieve this, individuals must adopt a multi-faceted approach that includes prioritizing spending categories, uncovering hidden savings opportunities, and strategically timing financial transactions. These essential budgeting tips can help you take control of your finances and work towards a more secure future.

Prioritizing Spending Categories

Prioritizing spending is crucial when managing finances on a limited income. Essential expenses such as rent/mortgage, utilities, and food should be the top priority. Allocating funds to these categories first ensures that basic needs are met before discretionary spending. By categorizing expenses into needs versus wants, individuals can make informed decisions about where to allocate their limited financial resources.

Finding Hidden Money in Your Budget

Often, there are opportunities to save money that are not immediately apparent. Reviewing subscription services, such as streaming platforms and gym memberships, can reveal areas where costs can be cut. Additionally, negotiating bills with service providers (like cable and internet companies) can lead to significant savings. Every dollar saved is a dollar that can be allocated towards more critical financial goals or emergency funds. These budgeting tips can help you make smarter financial decisions and achieve long-term financial stability.

Strategic Timing of Purchases and Bill Payments

The timing of purchases and bill payments can significantly impact one’s financial situation. Understanding and leveraging payment cycles can help in avoiding late fees and making the most of sales or discounts.

Using Payment Cycles to Your Advantage

Being aware of the payment cycles of regular bills, such as utility bills and credit card payments, allows individuals to plan their payments strategically. For instance, paying bills early can sometimes result in discounts or avoid late penalties. Moreover, synchronizing bill payments with income receipt dates can help in managing cash flow more effectively.

By implementing these strategies, individuals on a low income can maximize the utility of their budget, ensuring that every dollar contributes towards financial stability and long-term goals.

Exploring Ways to Supplement Your Income

When you’re on a low income, discovering new income sources can be incredibly empowering. Supplementing your earnings can help you better manage your finances, pay off debts, and even start saving.

Side Hustles Compatible with Full-Time Work

One effective way to boost your income is by taking up a side hustle that complements your full-time job. This could be freelancing, tutoring, or selling handmade products online. The key is to find something you’re skilled at and can manage alongside your primary job.

Skill Development for Better Job Opportunities

Investing in skill development can lead to better job prospects and higher pay. Consider online courses or vocational training that can enhance your employability and open up new career paths.

Government Assistance and Community Programs

Many governments offer assistance programs for low-income individuals. Research local and national programs that you might be eligible for, such as food assistance or housing support.

Qualifying for Benefits While Working

Even if you’re working, you might still qualify for certain benefits. Understand the eligibility criteria for various programs and apply accordingly to maximize your support.

By exploring these options, you can create a more stable financial foundation. Using a low-income budget planner can also help you manage your finances more effectively, ensuring that you’re making the most of your income and any additional support you receive. These budgeting tips can guide you in making informed decisions, leading to better financial management and long-term success.

Managing Debt While on a Tight Budget

Effectively managing debt while on a tight budget requires a combination of strategy, discipline, and the right resources. For many low-income individuals, debt can seem like an insurmountable challenge, but there are proven methods to regain control over finances.

Debt Prioritization Strategies

One of the first steps in managing debt is prioritizing your debts. This can be done using the debt avalanche or debt snowball method. The debt avalanche involves paying off debts with the highest interest rates first, while the debt snowball method focuses on eliminating the smallest debts first to build momentum.

Negotiating with Creditors

Another effective strategy is negotiating with creditors. Many creditors are willing to work with debtors to establish a more manageable payment plan. This can include reducing interest rates, waiving fees, or extending payment deadlines. These budgeting tips can help you manage debt more effectively and reduce financial stress in the long term.

Low-Income Debt Relief Options

There are also debt relief options specifically designed for low-income individuals. These can include non-profit credit counseling services and debt management plans. It’s essential to research these options carefully to find the one that best suits your financial situation.

Avoiding Predatory Lending Traps

When seeking debt relief, it’s crucial to avoid predatory lending traps. Be wary of services that promise quick fixes or charge exorbitant fees. Always research the credibility of a debt relief service before committing.

By employing these strategies and being mindful of potential pitfalls, individuals on a tight budget can effectively manage their debt and move towards financial stability.

Tools and Resources for Low-Income Budgeting

Budgeting on a low income can be simplified with the use of appropriate financial tools and resources. Effective management of limited finances requires access to the right support systems. These budgeting tips can help you optimize your financial strategies and make the most of your income.

Free Budgeting Apps and Websites

Several free budgeting apps and websites can help individuals manage their finances more efficiently. Some popular options include Mint, Personal Capital, and YNAB (You Need a Budget).

- Mint offers comprehensive financial tracking and budgeting tools.

- Personal Capital provides detailed investment tracking and financial planning.

- YNAB focuses on helping users manage their budgets by assigning jobs to every dollar.

Community Financial Resources

Community resources can provide additional support for low-income individuals. Local non-profits, financial counseling services, and government programs can offer assistance with budgeting and financial planning. These budgeting tips from community resources can help guide you toward better financial management and stability.

Financial Education Opportunities

Acquiring financial knowledge is crucial for effective budgeting. Financial education can be obtained through various channels.

Library and Online Learning Resources

Libraries often provide free access to financial education resources, including books and online courses. Websites like Coursera, edX, and Khan Academy offer affordable or free courses on personal finance.

| Resource | Description | Cost |

|---|---|---|

| Mint | Comprehensive financial tracking | Free |

| Personal Capital | Investment tracking and financial planning | Free |

| Coursera | Online courses on personal finance | Varies |

Building an Emergency Fund with Limited Income

An emergency fund is a financial cushion that can help you navigate unexpected expenses. When you’re managing money on a low income, building such a fund can seem like a daunting task. However, it’s a crucial step towards achieving financial stability. Incorporating budgeting tips to allocate even small amounts towards this fund can make it more achievable over time.

Starting Small: The $500 Safety Net

Starting small is a practical approach to building an emergency fund. Aiming for a $500 safety net can be a realistic initial goal. This amount can cover minor emergencies, such as car repairs or medical bills, helping you avoid debt.

Consistent Saving Strategies

Consistency is key when saving for an emergency fund on a limited income. Strategies include:

- Setting aside a fixed amount regularly, even if it’s small.

- Using a separate savings account specifically for your emergency fund.

- Automating your savings through direct deposit or transfers.

When and How to Use Your Emergency Fund

Your emergency fund should be used for genuine emergencies only, such as unexpected medical expenses, essential car repairs, or losing your job. It’s essential to define what constitutes an emergency to avoid depleting your fund unnecessarily.

Rebuilding After Using Emergency Savings

After using your emergency fund, it’s crucial to rebuild it. This involves going back to your saving strategies and possibly adjusting your budget to allocate more funds towards rebuilding your safety net. Rebuilding is as important as building it initially, ensuring you’re prepared for future emergencies. Budgeting tips can help you streamline this process and make it more efficient by identifying areas to cut back and boost your savings.

Conclusion: Maintaining Financial Discipline and Hope

Budgeting on a low income requires dedication, patience, and the right strategies. By understanding your financial situation, setting realistic goals, and applying effective budgeting tips, you can navigate the challenges of low income budgeting.

Maintaining financial discipline is crucial to achieving long-term financial stability. This involves consistently tracking your expenses, prioritizing your spending, and making adjustments as needed. By doing so, you can ensure that you are making the most of your limited income.

Staying hopeful and committed to your financial goals is equally important. Celebrate your small victories, and don’t be discouraged by setbacks. With persistence and the right mindset, you can overcome the challenges of budgeting on a low income and work towards a more financially secure future.

By applying the principles of low-income budgeting and following essential budgeting tips, you can take control of your finances and make progress towards your financial objectives. Stay focused, and you’ll be on your way to achieving financial stability.

FAQ

What is the best way to start budgeting on a low income?

The best way to start budgeting on a low income is by tracking all income sources, identifying and categorizing expenses, and calculating your financial baseline. These budgeting tips will help you understand your financial standing and make informed decisions.

How can I prioritize my expenses when I have a limited income?

To prioritize expenses on a limited income, focus on essential needs such as housing, food, and utilities. Use the 50/30/20 rule as a guideline, allocating 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. These budgeting tips can help you maintain a balance and make the most of your income.

What are some effective strategies for reducing expenses on a low income?

Effective strategies for reducing expenses include housing cost reduction techniques, minimizing food expenses without sacrificing nutrition, reducing utility bills, and cutting transportation costs. Consider using the envelope system for cash management and exploring digital alternatives. These budgeting tips can help you stay on track and maximize your savings.

How can I supplement my low income?

Supplementing a low income can be achieved through side hustles compatible with full-time work, skill development for better job opportunities, and government assistance programs. Research and explore community resources and financial education opportunities to maximize your income. Along with these strategies, consider these budgeting tips to help you manage and grow your financial resources effectively.

What are some low-income debt relief options?

Low-income debt relief options include debt prioritization strategies, negotiating with creditors, and exploring government assistance programs. Be cautious of predatory lending traps and seek financial education to manage debt effectively. Additionally, consider implementing budgeting tips to help you regain financial control and reduce debt more efficiently.

How can I build an emergency fund with a limited income?

Building an emergency fund on a limited income starts with setting a goal, such as saving $500 as a safety net. Implement consistent saving strategies, and use your emergency fund wisely. Rebuild your fund after using it by continuing to save.

Are there any free budgeting apps and resources available for low-income individuals?

Yes, there are several free budgeting apps and resources available, including budgeting websites, community financial resources, and financial education opportunities. Utilize library and online learning resources to improve your financial literacy. For more practical budgeting tips, check out available resources that can help you take control of your finances.

How can I maintain financial discipline on a low income?

Maintaining financial discipline on a low income requires commitment to your financial goals, prioritizing needs over wants, and consistently tracking expenses. Stay informed about financial management and adjust your budget as needed to stay on track. For more guidance, explore budgeting tips that can help you stay disciplined and achieve financial stability.