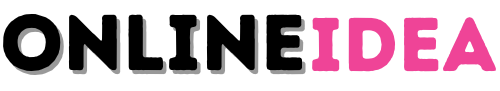

50/30/20 Rule: 7 Benefits of This Simple Budgeting Plan

Managing finances effectively is a challenge many face, with nearly 60% of Americans living paycheck to paycheck. A simple yet effective solution is the 50/30/20 budget allocation strategy, which simplifies financial management by dividing income into needs, wants, and savings.

This straightforward method has gained popularity for its ease of use and effectiveness in achieving financial stability. By allocating 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment, individuals can better manage their finances and avoid common pitfalls like These 10 budgeting mistakes.

Table of Contents

Understanding the 50/30/20 Rule

Understanding the 50/30/20 rule begins with its history and underlying principles. This rule is a simple yet effective method for allocating one’s income towards different expense categories, thereby facilitating better financial planning and money management.

Origin and Development of the Method

The 50/30/20 rule was popularized by Senator Elizabeth Warren in her book, All Your Worth: The Ultimate Lifetime Money Plan. The rule suggests dividing one’s after-tax income into three categories: 50% for necessary expenses, 30% for discretionary spending, and 20% for saving and debt repayment—helping many avoid Common budgeting mistakes.

This allocation method is designed to help individuals manage their finances effectively by prioritizing needs over wants and ensuring a significant portion is saved or used for debt repayment.

Core Principles Behind the Strategy

The core principle of the 50/30/20 rule lies in its simplicity and the emphasis on balancing expenditure with savings. By allocating 50% of one’s income towards necessary expenses, individuals ensure they can cover essential costs.

The remaining allocation ensures that there’s a balance between enjoying one’s life through discretionary spending (30%) and securing the future through savings and debt repayment (20%).

| Category | Percentage | Description |

|---|---|---|

| Necessary Expenses | 50% | Essential expenses like rent, utilities, and groceries. |

| Discretionary Spending | 30% | Non-essential expenses for enjoyment, such as hobbies and travel. |

| Savings and Debt Repayment | 20% | Allocations towards savings, emergency funds, and debt repayment. |

Benefits of Using the 50/30/20 Rule

The 50/30/20 budgeting method provides a clear and actionable framework for financial planning, making it easier to achieve financial goals. By allocating 50% of income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment, individuals can strike a balance between enjoying their current lifestyle and building a secure financial future, while avoiding Common budgeting mistakes.

Simplicity and Ease of Implementation

One of the primary advantages of the 50/30/20 rule is its simplicity. Unlike complex budgeting methods that require detailed expense tracking, this rule offers a straightforward approach that can be easily implemented by anyone. The simplicity of the rule makes it accessible to individuals with varying levels of financial literacy, allowing them to manage their finances effectively without feeling overwhelmed.

The ease of implementation is further enhanced by the rule’s flexibility. It does not require precise categorization of every single expense, making it a practical solution for busy individuals who want to manage their finances without dedicating too much time.

Flexibility Across Different Income Levels

The 50/30/20 rule is flexible and can be applied across different income levels, making it a versatile tool for achieving financial goals and implementing a successful wealth building strategy. Whether you’re earning a modest income or a substantial one, this rule helps in prioritizing expenses and savings. For instance, it can help low-income individuals allocate their limited resources more effectively, while high-income earners can use it to optimize their savings and investments.

Key benefits of the 50/30/20 rule include:

- Simplified budgeting process

- Improved financial discipline

- Enhanced savings rate

- Flexibility across different income levels

By adopting this rule, individuals can create a sustainable financial plan that aligns with their goals and income level.

Breaking Down the 50% for Needs

Understanding what constitutes ‘needs’ is crucial when applying the 50/30/20 budget allocation strategy. This rule suggests that 50% of one’s income should be dedicated to necessary expenses, ensuring a stable financial foundation. Effective financial planning hinges on correctly identifying and categorizing these essential expenditures.

What Qualifies as Essential Expenses

Essential expenses, or ‘needs,’ include costs that are necessary for survival and maintaining a basic standard of living. These expenses are typically non-discretionary, meaning they cannot be easily reduced or eliminated. Housing costs, such as rent or mortgage payments, are prime examples of essential expenses that usually form the largest component of this category. Learn how to manage these costs effectively with our guide on How to create a budget.

Other essential expenses may include utilities like electricity, water, and gas, as well as grocery bills and transportation costs. These expenditures are fundamental to daily living and are considered necessary for maintaining health and well-being.

Common Examples of “Needs” Category

Common examples of ‘needs’ include:

- Housing costs (rent/mortgage, property taxes, insurance)

- Utilities (electricity, water, gas, internet)

- Groceries and household supplies

- Transportation costs (car loan/lease, insurance, gas, maintenance)

- Minimum payments on debts (credit cards, loans)

As Warren Buffett once said, “Do not save what is left after spending, but spend what is left after saving.” This quote underscores the importance of prioritizing essential expenses and managing them effectively within the 50/30/20 framework.

Understanding the 30% for Wants

Understanding the 30% for wants is vital for effective money management and achieving financial harmony. This portion of the budget is dedicated to discretionary spending, allowing individuals to enjoy their lives and pursue personal interests.

The allocation for wants is not just about indulgence; it’s about maintaining a balanced lifestyle that includes leisure, hobbies, and personal development. By setting aside 30% of one’s income for these purposes, individuals can enjoy their current life while still working towards long-term financial goals.

Defining Discretionary Spending

Discretionary spending refers to expenses that are not essential for survival or basic needs. It’s about choosing how to spend money on things that bring joy, comfort, or personal fulfillment. This category can include a wide range of expenses, from dining out and entertainment to hobbies and travel.

Defining what constitutes discretionary spending can vary greatly from person to person, depending on individual preferences, lifestyle, and priorities. For some, discretionary spending might mean upgrading their living situation or purchasing luxury items, while for others, it could mean spending on experiences like concerts or sporting events. To better understand how to balance these expenses, check out our guide on How to create a budget.

Examples of Want-Based Expenses

Examples of want-based expenses can include:

- Dining out or ordering takeout

- Entertainment such as movies, concerts, or sporting events

- Hobbies or personal interests

- Travel or vacations

- Lifestyle upgrades, such as the latest gadgets or fashion

- Personal pampering, like spa treatments or salon services

These expenses are considered discretionary because they are not necessary for basic living. However, they play a significant role in enhancing one’s quality of life and overall happiness.

Maximizing the 20% for Savings and Debt

Maximizing the 20% portion of your income for savings and debt repayment is a key step towards securing your financial future. This allocation is crucial for building a safety net, achieving financial goals, and implementing a Wealth building strategy. Effective management of this portion can significantly impact your long-term financial stability.

Debt Repayment Strategies

One of the primary uses of the 20% allocation is debt repayment. Strategies for debt repayment include:

- Focusing on high-interest debts first, such as credit card balances

- Using the snowball method, where you pay off smaller debts first to build momentum

- Consolidating debts into a lower-interest loan or credit card

According to financial experts, “Paying off high-interest debt is a crucial step in achieving financial freedom.”

“The most effective debt repayment strategy is one that you can stick to consistently,”

emphasizes a financial advisor.

Emergency Fund Building

Building an emergency fund is another critical use of the 20% allocation. This fund acts as a financial cushion in case of unexpected expenses or job loss. Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account.

| Expense Category | Monthly Amount | 3-Month Savings Goal | 6-Month Savings Goal |

|---|---|---|---|

| Rent/Mortgage | $1,500 | $4,500 | $9,000 |

| Utilities | $200 | $600 | $1,200 |

| Food | $500 | $1,500 | $3,000 |

| Total | $2,200 | $6,600 | $13,200 |

Investment Allocation

The remaining amount after debt repayment and emergency fund building can be allocated towards investments. This could include retirement accounts, stocks, bonds, or real estate. A diversified investment portfolio is key to a successful wealth-building strategy.

For instance, allocating a portion of your 20% towards a retirement account can significantly enhance your financial security in the long run. “Starting early with retirement savings can make a substantial difference due to compound interest,” notes a financial planner.

Step-by-Step Implementation of the 50/30/20 Rule

A successful 50/30/20 budget allocation strategy starts with calculating your after-tax income. This foundational step is crucial for effective money management. By following a straightforward, step-by-step approach, you can easily implement this rule in your financial planning.

Calculating Your After-Tax Income

The first step in implementing the 50/30/20 rule is to determine your after-tax income. This is the amount of money you have available for spending and saving after income taxes have been deducted. To calculate this, you can start with your gross income and subtract the total amount of taxes paid. For example, if your annual gross income is $60,000 and you pay 20% in taxes, your after-tax income would be $48,000, or $4,000 per month.

It’s essential to use your after-tax income as the basis for your budget because it reflects the actual amount of money you have available for allocation.

Auditing and Categorizing Current Expenses

Once you have determined your after-tax income, the next step is to audit and categorize your current expenses. This involves tracking every single transaction you make over a certain period, typically a month, to understand where your money is going. You can use a spreadsheet, a budgeting app, or even just a notebook to record your expenses.

After collecting data on your expenses, categorize them into needs (50% of your after-tax income), wants (30%), and savings/debt repayment (20%). Common categories include housing, utilities, groceries, transportation, entertainment, and debt repayment. By categorizing your expenses, you can identify areas where you can adjust your spending to align with the 50/30/20 rule.

Adjusting Your Budget to Match the Rule

After categorizing your expenses, you may find that your current spending does not align with the 50/30/20 proportions. This is a common challenge, but it can be addressed by making adjustments. Start by identifying areas where you can cut back on discretionary spending (wants) and allocate that money towards savings or debt repayment.

For instance, if you find that you’re spending more than 30% on wants, consider reducing dining out or canceling subscription services you don’t use. Here are some key strategies to adjust your budget:

- Reduce unnecessary expenses

- Negotiate bills and fees

- Increase income through a side job or selling unwanted items

- Automate savings and debt repayment

By making these adjustments, you can bring your budget into alignment with the 50/30/20 rule, enhancing your overall Budget allocation strategy and improving your financial health.

Practical Examples of the 50/30/20 Budget Allocation

To illustrate the versatility of the 50/30/20 rule, let’s examine two distinct income scenarios. This will help in understanding how individuals with different annual incomes can effectively allocate their resources.

Example for $40,000 Annual Income

For someone earning $40,000 annually, or approximately $3,333 per month, applying the 50/30/20 rule involves allocating 50% of their income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

| Category | Percentage | Monthly Amount |

|---|---|---|

| Necessary Expenses | 50% | $1,666.50 |

| Discretionary Spending | 30% | $1,000 |

| Savings and Debt Repayment | 20% | $666.60 |

This breakdown helps in financial planning by ensuring that essential expenses are covered while also making progress on savings and debt.

Example for $80,000 Annual Income

For an individual with an $80,000 annual income, or about $6,667 per month, the 50/30/20 rule allocates $3,333.50 towards necessary expenses, $2,000 towards discretionary spending, and $1,333.40 towards savings and debt repayment.

| Category | Percentage | Monthly Amount |

|---|---|---|

| Necessary Expenses | 50% | $3,333.50 |

| Discretionary Spending | 30% | $2,000 |

| Savings and Debt Repayment | 20% | $1,333.40 |

By following this rule, individuals can make significant progress in their investment percentages and overall financial health.

Common Challenges When Applying the 50/30/20 Rule

While the 50/30/20 rule offers a straightforward budgeting approach, its application isn’t always straightforward. Individuals may face various challenges that make it difficult to adhere to this rule.

High Cost of Living Areas

Living in areas with a high cost of living can significantly impact one’s ability to follow the 50/30/20 rule. Housing costs, in particular, can consume a large portion of one’s income.

For instance, in cities like New York or San Francisco, rent or mortgage payments can easily exceed the 50% threshold allocated for necessary expenses. This forces individuals to either adjust their lifestyle or reallocate funds from other categories.

| Category | 50/30/20 Allocation | High Cost of Living Adjustment |

|---|---|---|

| Necessary Expenses | 50% | 60% or more |

| Discretionary Spending | 30% | 20% or less |

| Savings and Debt Repayment | 20% | 20% or less |

Irregular Income Situations

Another challenge arises for individuals with irregular incomes, such as freelancers or those in commission-based jobs. Their income variability makes it difficult to consistently allocate funds according to the 50/30/20 rule.

To manage this, individuals can consider averaging their income over several months to create a more stable budget or adjusting their spending habits based on the income received each month.

Adapting the 50/30/20 Rule for Different Life Stages

Adapting the 50/30/20 rule to different life stages is crucial for effective financial planning and achieving long-term financial stability. As individuals progress through various life stages, their financial priorities and responsibilities change, necessitating adjustments to this budgeting rule.

For Young Professionals

Young professionals often face unique financial challenges, such as student loan debt and entry-level salaries. For this group, the 50/30/20 rule can be adapted by prioritizing debt repayment and initial savings efforts. For instance, allocating more than 20% towards debt repayment and savings can be beneficial. It’s essential to strike a balance between enjoying one’s income and building a financial foundation. Learn how to tailor your budget effectively by visiting our guide on How to create a budget.

A practical example is to allocate 50% towards necessary expenses like rent and utilities, 30% towards discretionary spending, and potentially more than 20% towards debt repayment and savings.

For Families with Children

Families with children have different financial priorities, including education expenses and family activities. The 50/30/20 rule can be adjusted to accommodate these needs. For example, families might need to allocate a larger portion of their income towards essential expenses, such as housing and groceries, potentially reducing the percentage allocated to wants.

| Category | Allocation Percentage | Example Expenses |

|---|---|---|

| Needs | 55% | Housing, groceries, utilities |

| Wants | 25% | Dining out, entertainment |

| Savings/Debt | 20% | Emergency fund, education savings |

For Pre-Retirement Planning

As individuals approach retirement, their financial priorities often shift towards maximizing savings and investments. The 50/30/20 rule can be adapted to focus more on savings and debt repayment, potentially reducing discretionary spending.

“The key to a successful retirement is not just saving, but saving effectively.” –

Financial Advisor

Allocating a larger portion towards retirement accounts and other long-term investments becomes crucial.

By adapting the 50/30/20 rule to different life stages, individuals can better manage their finances, achieve financial stability, and work towards their long-term financial goals.

Using the 50/30/20 Rule to Achieve Financial Goals

The 50/30/20 rule offers a straightforward approach to managing finances and achieving financial objectives. By allocating 50% of one’s income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment, individuals can create a balanced financial plan.

This rule can be particularly effective in helping individuals achieve their financial goals, whether they are short-term, medium-term, or long-term. By prioritizing savings and debt repayment, individuals can make significant progress toward their objectives.

Short-Term Goal Setting

Short-term financial goals typically span less than a year and may include building an emergency fund, paying off high-interest debt, or saving for a specific expense. By allocating 20% of one’s income towards savings and debt repayment, individuals can make steady progress toward these goals. For instance, using high-yield savings accounts or debt consolidation loans can enhance the effectiveness of this allocation.

Medium-Term Financial Planning

Medium-term financial goals, which typically range from one to five years, may include saving for a down payment on a house, funding a major purchase, or financing education expenses. The 50/30/20 rule can help individuals allocate funds effectively toward these goals by maintaining a disciplined approach to saving and investing. For example, considering certificates of deposit (CDs) or other medium-term investment vehicles can be beneficial.

Long-Term Wealth Building Strategy

Long-term financial goals, such as retirement savings or wealth accumulation, require sustained effort and a well-planned strategy. The 20% allocation for savings and debt repayment under the 50/30/20 rule can be particularly beneficial for long-term wealth building. Utilizing retirement accounts such as 401(k) or IRA, and considering diversified investment portfolios, can help individuals achieve their long-term financial objectives.

Tools and Apps to Support Your 50/30/20 Budget

The 50/30/20 budget rule becomes more manageable with the aid of various budgeting tools and applications. By leveraging technology, individuals can streamline their financial management, making it easier to allocate income according to the 50/30/20 principle.

Free Budgeting Resources

Several free budgeting resources are available to help implement the 50/30/20 rule. Personal Capital is a popular choice, offering comprehensive financial tracking and budgeting tools at no cost. Additionally, Mint provides a user-friendly interface for categorizing expenses and monitoring budget adherence.

Other free resources include spreadsheet templates, such as those found in Google Sheets or Microsoft Excel, which can be customized to fit the 50/30/20 framework. These tools enable users to track their income and expenses, ensuring alignment with their budget allocation strategy.

Premium Budgeting Solutions

For those seeking more advanced features, premium budgeting solutions are available. YNAB (You Need a Budget) is a highly-regarded app that offers robust budgeting tools, including automated savings features and investment tracking. Although it requires a subscription, YNAB provides a comprehensive platform for managing finances according to the 50/30/20 rule.

Another premium option is Quicken, which provides detailed financial planning and budgeting capabilities, including investment monitoring and bill tracking. These premium solutions can enhance money management by offering more sophisticated tools and support.

Comparing the 50/30/20 Rule to Other Budgeting Methods

Financial planning can be approached in multiple ways, with the 50/30/20 rule standing out for its simplicity, but other methods like the envelope system and 70/20/10 rule also have their strengths. Understanding these different budgeting strategies can help individuals choose the best method for their financial situation.

Zero-Based Budgeting

Zero-based budgeting is a meticulous method where every dollar is accounted for, with expenses justified and aligned with financial goals. This approach can be more time-consuming than the 50/30/20 rule but offers a detailed view of one’s financial landscape. As Financial expert Dave Ramsey notes, “Every dollar should have a name, a purpose, and a destination.”

Unlike the 50/30/20 rule, zero-based budgeting doesn’t allocate fixed percentages to needs, wants, and savings. Instead, it dynamically adjusts based on the individual’s financial priorities.

Envelope System

The envelope system is a tangible budgeting method where expenses are categorized, and cash is allocated into envelopes for each category. This visual and tactile approach can help control spending, especially for those who struggle with credit card debt. However, it may not be as flexible or scalable as the 50/30/20 rule for managing long-term investments or savings goals.

70/20/10 Method

The 70/20/10 rule allocates 70% of income towards expenses, 20% towards savings, and 10% towards debt repayment or charitable giving. While similar to the 50/30/20 rule, it offers a different balance that might suit individuals with specific financial goals or debt obligations. As financial advisor Jean Chatzky suggests, “The key is finding a balance that works for you and sticking to it.”

This method emphasizes debt repayment and giving, making it a good choice for those looking to aggressively pay off debt or support charitable causes.

In conclusion, while the 50/30/20 rule offers a straightforward and flexible budgeting framework, other methods like zero-based budgeting, the envelope system, and the 70/20/10 rule provide alternative approaches tailored to different financial needs and preferences. By understanding these options, individuals can select the most appropriate wealth building strategy for their circumstances.

Common Mistakes to Avoid with the 50/30/20 Rule

While the 50/30/20 rule offers a simple and effective way to manage finances, there are common mistakes to watch out for. Effective money management requires not just following a budgeting rule, but also understanding how to apply it correctly to achieve your financial goals.

One of the primary challenges individuals face when implementing the 50/30/20 rule is accurately categorizing their expenses. This brings us to the first common mistake.

Misclassifying Expenses

Misclassifying expenses is a common pitfall when using the 50/30/20 rule. It’s easy to confuse needs with wants, leading to improper budget allocation. For instance, dining out might be classified as a need if not carefully considered.

| Category | Examples | Potential Misclassification |

|---|---|---|

| Needs | Rent, Utilities, Groceries | Misclassifying dining out as groceries |

| Wants | Dining out, Entertainment, Hobbies | Classifying a hobby as a need |

| Savings | Emergency fund, Retirement savings | Neglecting to allocate for savings |

Neglecting Regular Budget Reviews

Another critical mistake is neglecting to review and adjust the budget regularly. Financial situations can change due to various factors such as income fluctuations, changes in family size, or unexpected expenses. Regular reviews help in making necessary adjustments to stay on track with your financial goals.

By being aware of these common mistakes and taking steps to avoid them, individuals can more effectively use the 50/30/20 rule to enhance their money management skills and achieve financial stability.

Conclusion

Implementing the 50/30/20 rule can be a transformative step in managing your finances effectively. By allocating 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment, you can achieve a balanced budget allocation strategy.

This straightforward budgeting method simplifies financial planning and money management, enabling you to make the most of your investment percentages and work towards your financial goals.

By adopting the 50/30/20 rule, individuals can develop a wealth building strategy that is both sustainable and effective. It’s essential to regularly review and adjust your budget to ensure it remains aligned with your changing financial needs and objectives.

By doing so, you’ll be well on your way to achieving financial stability and securing a prosperous financial future through effective financial planning.

FAQ

What is the 50/30/20 rule, and how does it work?

The 50/30/20 rule is a budgeting method that suggests allocating 50% of one’s income towards necessary expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment. This simple yet effective strategy helps individuals manage their finances and achieve financial stability.

Is the 50/30/20 rule suitable for all income levels?

Yes, the 50/30/20 rule is flexible and can be adapted to various income levels. It provides a straightforward framework for allocating resources, making it a versatile tool for achieving financial goals, regardless of one’s income.

How do I categorize my expenses using the 50/30/20 rule?

To categorize expenses, start by identifying necessary expenses (50%), such as housing, utilities, and food. Discretionary spending (30%) includes entertainment, hobbies, and lifestyle upgrades. Finally, allocate 20% towards savings, debt repayment, and investments.

What are some common challenges when applying the 50/30/20 rule?

Common challenges include living in high-cost areas, having irregular incomes, and misclassifying expenses. To overcome these challenges, it’s essential to regularly review and adjust your budget, making adjustments as needed to stay on track.

Can the 50/30/20 rule be used for long-term financial planning?

Yes, the 50/30/20 rule can be an effective tool for long-term financial planning. By allocating 20% of your income towards savings and debt repayment, you can build wealth over time and achieve long-term financial goals, such as retirement savings or buying a home.

Are there any tools or apps that can help me implement the 50/30/20 rule?

Yes, there are various tools and apps available that can aid in implementing and maintaining a 50/30/20 budget. Some popular options include free budgeting resources like Mint and Personal Capital, as well as premium solutions like YNAB (You Need a Budget) and Quicken.

How often should I review my budget to ensure I’m on track with the 50/30/20 rule?

It’s essential to regularly review your budget to ensure you’re on track with the 50/30/20 rule. Schedule regular budget reviews, ideally every few months, to assess your progress, make adjustments, and stay committed to your financial goals.