10 Major Budgeting Mistakes to Avoid in 2025

As we step into 2025, managing personal finances effectively is more crucial than ever. With economic fluctuations and changing financial landscapes, avoiding common financial planning pitfalls is key to securing a stable financial future.

Making smart financial decisions requires a thorough understanding of where your money is going and how to allocate it wisely. By Learning how to create a budget and steering clear of prevalent budgeting mistakes, individuals can better navigate their financial journeys.

Effective personal finance management is about cutting expenses and making informed decisions that align with your long-term financial goals. As we explore the top 10 budgeting mistakes to avoid in 2025, you’ll gain valuable insights into enhancing your financial planning strategies.

Table of Contents

The Financial Landscape of 2025

Unprecedented economic shifts mark the financial landscape of 2025. As a result, understanding the current economic trends and their impact on personal finance is crucial for effective money management. One of the best ways to stay prepared is by Learning how to create a budget that aligns with your financial goals.

Economic Trends Affecting Personal Finance

Several economic trends are significantly affecting personal finances in 2025. These include:

- Inflation Rate Fluctuations: Changes in inflation rates are impacting the purchasing power of consumers.

- Market Volatility: Stock market fluctuations are affecting investment strategies.

- Shifts in Consumer Behavior: Changes in consumer spending habits are influencing market demands.

These trends underscore the importance of adapting financial strategies to the current economic climate.

Why Effective Budgeting Matters Now More Than Ever

Effective budgeting is crucial in 2025 due to the prevailing economic uncertainty. A well-planned budget helps individuals navigate financial challenges by:

- Prioritizing expenses in line with changing economic conditions.

- Identifying areas for cost reduction.

- Allocating resources efficiently to savings and investments.

By adopting a proactive approach to budgeting, individuals can better manage financial risks and capitalize on opportunities in the evolving financial landscape of 2025.

Common Budgeting Mistakes That Derail Financial Progress

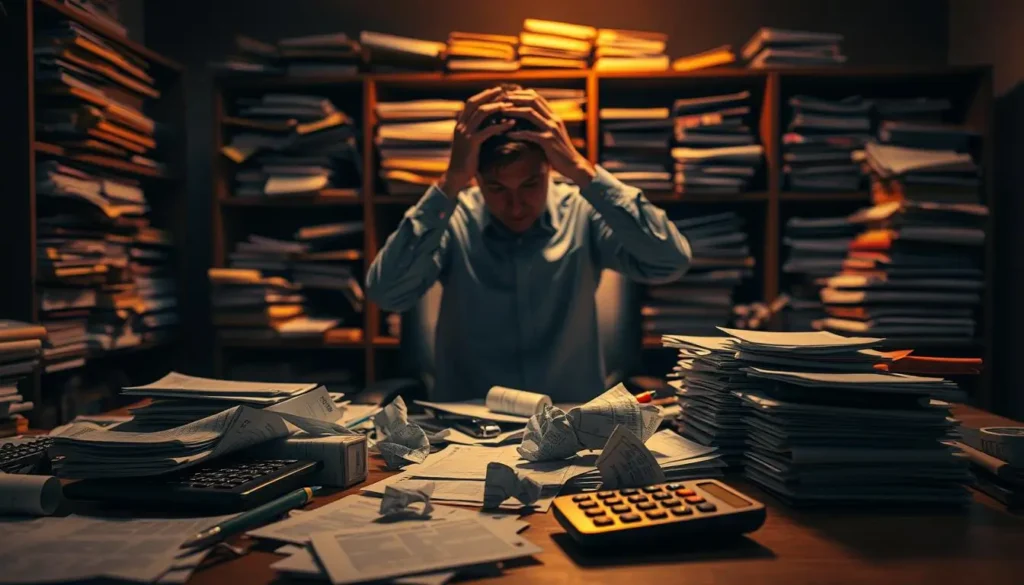

Effective financial planning is crucial in achieving long-term financial stability, yet many individuals fall prey to common budgeting mistakes that can significantly hinder their financial progress.

Understanding the psychological aspects of financial decision-making is essential in avoiding these pitfalls. Financial stress can lead to a vicious cycle of poor financial choices, further exacerbating the stress. This phenomenon is often referred to as the “financial stress loop.”

The Psychological Impact of Poor Financial Planning

Poor financial planning can have profound psychological effects, including increased stress levels, anxiety, and a sense of financial insecurity. When individuals fail to manage their finances effectively, they may feel overwhelmed by debt, uncertain about their financial future, or trapped in a cycle of living paycheck to paycheck.

The psychological impact can be so severe that it affects other areas of life, including relationships and overall well-being. Therefore, it’s crucial to address financial planning mistakes early on to mitigate these negative effects.

How Small Errors Compound Over Time

Small budgeting errors, such as underestimating expenses or failing to account for irregular expenditures, can compound over time, leading to significant financial setbacks. For instance, neglecting to Create a budget that includes annual or semi-annual expenses can result in financial strain when these costs arise.

| Error Type | Short-Term Impact | Long-Term Impact |

|---|---|---|

| Underestimating Expenses | Minor budget variance | Significant financial strain |

| Ignoring Irregular Expenses | Occasional financial stress | Recurring financial crises |

| Failing to Adjust for Inflation | Minimal impact | Eroded purchasing power |

By understanding these common budgeting mistakes and their potential long-term impacts, individuals can take proactive steps to rectify their financial planning strategies, thereby safeguarding their financial progress.

Mistake 1: Not Having a Budget at All

Failing to establish a budget is a common pitfall that can have long-lasting financial consequences. Many individuals mistakenly believe they can manage their finances effectively without a structured plan.

The “I’ll Track It Mentally” Fallacy

Relying on mental tracking of expenses is a flawed strategy that often leads to overspending and financial disorganization. Research shows that our brains can only keep track of a limited number of financial transactions before accuracy begins to decline. This can result in forgotten expenses, missed payments, and a lack of clear financial direction.

Setting Up Your First Budget Framework

Creating a budget framework is simpler than it seems. Start by identifying your income sources and fixed expenses. Utilizing a budgeting app or spreadsheet can streamline this process. Categorize your expenses into needs (housing, food, utilities) and wants (entertainment, hobbies).

For those new to budgeting, digital tools can provide a user-friendly introduction. Apps like Mint, You Need a Budget (YNAB), and Personal Capital offer intuitive interfaces and automated tracking features. These tools can help you stay on top of your finances with minimal effort.

Simple Pen-and-Paper Systems That Work

For those who prefer a more traditional approach, pen-and-paper budgeting can be effective. Methods like the envelope system, where expenses are categorized and cash is allocated into labeled envelopes, can provide a tangible connection to your Money management. This hands-on approach can be particularly useful for managing discretionary spending.

By adopting either a digital or traditional budgeting method, individuals can take the first step towards financial stability and avoid the pitfalls of not having a budget.

Mistake 2: Ignoring Irregular Expenses

Failing to account for irregular expenses can disrupt even the most well-intentioned budget, leading to unexpected financial challenges. Irregular expenses, such as annual insurance premiums or property taxes, can significantly impact one’s financial stability if not properly planned for.

Mapping Out Annual and Quarterly Expenses

To avoid the pitfalls of irregular expenses, it’s crucial to first identify and map out these costs. Start by reviewing past bank statements and financial records to pinpoint expenses that occur annually or quarterly. Common examples include car insurance premiums, property taxes, and holiday expenses. Once identified, categorize these expenses based on their frequency and amount.

Creating Effective Sinking Funds

A sinking fund is a dedicated savings account for specific, anticipated expenses. Creating a sinking fund for irregular expenses can help distribute the financial burden more evenly throughout the year. This approach, especially when paired with a solid Budgeting plan, prevents the need for last-minute, high-impact payments that can derail your budget.

Calculating the Right Monthly Contributions

To calculate the monthly contribution needed for a sinking fund, divide the total annual or quarterly expense by the number of months until the expense is due. For instance, if your annual car insurance premium is $1,200 due in June, you should save $100 per month from January to June.

Where to Keep Your Sinking Fund Money

It’s advisable to keep your sinking fund money separate from your everyday spending money. Consider opening a high-yield savings account specifically for this purpose. This not only keeps the funds separate but also earns interest, contributing to the overall health of your financial plan.

By incorporating sinking funds into your financial planning, you can better manage irregular expenses and maintain a stable financial trajectory. This proactive approach ensures that you’re prepared for expenses when they arise, reducing financial stress and promoting long-term stability.

Mistake 3: Underestimating Monthly Expenses

Underestimating monthly expenses is a financial pitfall that can derail even the most well-intentioned budgets. This oversight can lead to a cascade of financial issues, from overspending to accumulating debt.

Categories Most People Consistently Underbudget

Certain expense categories are more prone to being underestimated than others. Grocery bills often exceed initial estimates due to impulse purchases or sales-driven buying. Utility bills can fluctuate seasonally, catching many off guard. Additionally, Transportation costs, including fuel and maintenance, frequently surpass budgeted amounts.

To avoid these pitfalls, it’s essential to review historical spending patterns and adjust budgets accordingly. This involves not just accounting for regular expenses but also anticipating irregular costs that can impact monthly expenditures.

The 30-Day Expense Tracking Challenge

One effective method to accurately gauge monthly expenses is by undertaking the 30-day expense tracking challenge. This involves meticulously recording every single transaction, no matter how small, over a month. The goal is to gain a clear picture of spending habits and identify areas where costs can be optimized.

Apps That Automatically Categorize Spending

Utilizing budgeting apps can significantly simplify the expense tracking process. Apps like Mint, Personal Capital, and YNAB (You Need a Budget) automatically categorize spending, providing a detailed breakdown of where money is being spent. These tools help in pinpointing areas of overspending and enable more accurate budgeting.

Adjusting Your Budget Based on Real Data

Once you have collected data on your spending habits, it’s crucial to Adjust your budget accordingly. This may involve reallocating funds to categories that consistently exceed initial estimates. It’s also important to identify areas where costs can be cut back without significantly impacting quality of life.

By adopting a more informed and flexible approach to budgeting, individuals can better navigate the complexities of monthly expenses and make more effective financial decisions.

Mistake 4: Setting Unrealistic Financial Goals

Unrealistic financial goals can derail even the most well-intentioned budgeting efforts. When individuals set targets that are too ambitious or unachievable, they risk discouragement and abandonment of their financial plans.

Why Extreme Budgeting Leads to Failure

Extreme budgeting often results from setting unrealistic financial goals. This approach can lead to frustration and burnout, as individuals may feel they are making sacrifices without achieving tangible results. Extreme measures are typically unsustainable and can negatively impact one’s quality of life.

For instance, drastically cutting expenses without a clear plan for long-term sustainability can lead to financial strain. It’s essential to strike a balance between saving and maintaining a reasonable standard of living.

Developing SMART Financial Objectives

Adopting SMART (Specific, Measurable, Achievable, Relevant, Time-bound) financial objectives is a more effective approach. This framework helps in creating clear, actionable plans that are aligned with one’s financial situation and goals.

Creating Milestones That Motivate Rather Than Discourage

Breaking down larger financial goals into smaller, manageable milestones can enhance motivation. For example, instead of aiming to save $10,000 in a year, setting a goal to save $833 per month makes the task less daunting.

- Identify specific financial targets.

- Establish a timeline for achieving these targets.

- Regularly review and adjust the goals as necessary.

Building Flexibility Into Your Goals

Financial planning should be flexible to accommodate unexpected expenses or changes in income. Building a buffer into your budget can help mitigate the impact of financial shocks.

A table illustrating a simple budgeting plan with flexibility might look like this:

| Category | Initial Budget | Flexible Budget |

|---|---|---|

| Groceries | $500 | $550 |

| Entertainment | $200 | $250 |

| Emergency Fund | $100 | $150 |

By incorporating flexibility and setting realistic milestones, individuals can create a more effective and sustainable financial plan.

Mistake 5: Not Adjusting Your Budget for Inflation

As we navigate the complexities of personal finance in 2025, one critical mistake to avoid is failing to adjust your budget for Inflation. Inflation can erode your purchasing power, making it essential to adapt your financial plans to maintain your standard of living.

The impact of inflation on personal finance cannot be overstated. As prices rise, the same amount of money can buy fewer goods and services. This makes it crucial to understand the inflation projections for 2025 and adjust your budget accordingly.

2025 Inflation Projections by Category

Inflation projections for 2025 vary across different categories. Understanding these projections can help you make informed decisions about your budget.

- Food and Energy: Expected to see a moderate increase due to global demand and supply chain factors.

- Housing: Anticipated to rise as rental costs and housing prices continue to climb.

- Healthcare: Projected to increase due to rising medical costs and insurance premiums.

Strategies to Inflation-Proof Your Spending Plan

To mitigate the effects of inflation, it’s essential to employ effective budgeting strategies. Here are some approaches to consider:

Price-Tracking Tools for Smart Shopping

Utilizing price-tracking tools can help you make informed purchasing decisions. These tools allow you to monitor price changes and identify the best times to buy.

- CamelCamelCamel for tracking price history on Amazon.

- Keepa for monitoring product price changes over time.

Income Adjustments to Counter Rising Costs

Adjusting your income to counteract inflation is crucial. This can involve seeking salary increases, investing in inflation-protected securities, or diversifying your income streams.

- Negotiate a cost-of-living adjustment with your employer.

- Invest in Treasury Inflation-Protected Securities (TIPS).

- Explore alternative income sources, such as rental properties or dividend-paying stocks.

By understanding inflation projections and implementing these strategies, you can protect your financial health and maintain your standard of living in 2025.

Mistake 6: Forgetting to Budget for Savings and Investments

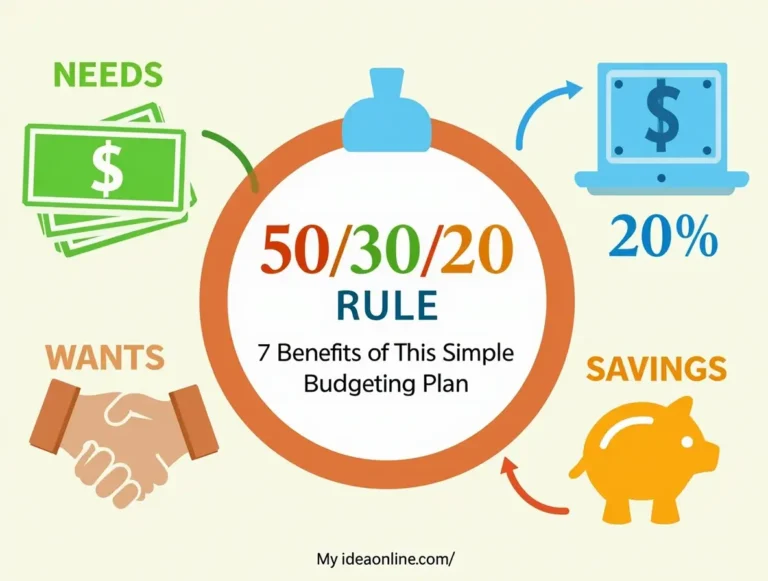

One of the most critical budgeting mistakes is forgetting to allocate funds for savings and investments. A well-structured Budget is not just about managing expenses; it’s also about building wealth and securing your financial future. Effective financial planning involves striking a balance between spending today and saving for tomorrow.

To avoid this common pitfall, it’s essential to understand the importance of prioritizing savings and investments within your budget. This involves adopting strategies that ensure you’re setting aside a portion of your income regularly.

Implementing the “Pay Yourself First” Principle

The “Pay Yourself First” principle is a straightforward yet powerful budgeting tip. It involves setting aside a portion of your income for savings and investments as soon as you receive it, rather than waiting until the end of the month. This approach helps ensure that you prioritize your financial goals over discretionary spending.

Optimal Savings Allocations for Different Life Stages

Different life stages require different savings allocations. For instance, younger individuals may focus more on retirement savings, while those closer to retirement might prioritize more conservative, liquid savings.

Emergency Fund Targets for 2025

An emergency fund is crucial for financial stability. For 2025, experts recommend saving three to six months’ worth of living expenses in an easily accessible savings account.

Retirement Contribution Strategies

Contributing to retirement accounts such as 401(k) or IRA is a key component of long-term financial planning. It’s advisable to contribute enough to take full advantage of any employer match and to consider increasing contributions over time.

Short and Medium-Term Investment Goals

For short and medium-term investment goals, consider allocating funds to vehicles that balance risk and return appropriately, such as high-yield savings accounts or short-term bond funds.

By implementing these strategies and making savings and investments a priority, you can avoid the mistake of neglecting your financial future.

Mistake 7: Neglecting to Review and Adjust Your Budget

A budget is not a static document; it requires regular reviews and adjustments to remain effective. As your financial situation changes, your budget should adapt to reflect these changes, ensuring that you remain on track to meet your financial goals.

Warning Signs Your Budget Needs Updating

Several indicators suggest that your budget needs a review. These include significant changes in income, unexpected expenses, or shifts in financial goals. If you find yourself consistently struggling to meet your budgeted targets or if you’re frequently dipping into savings or credit, it’s a sign that your budget needs adjustment.

Establishing an Effective Budget Review System

To keep your budget relevant and effective, implementing a regular review system is crucial. This involves multiple layers of checks to ensure your financial plan stays aligned with your current situation.

Weekly Quick Checks (15 Minutes)

Weekly reviews involve a quick glance at your spending and income to ensure you’re on track. This can be as simple as checking your bank accounts and comparing actual spending against your budgeted amounts for the week.

Monthly Reconciliation Process

At the end of each month, take a more detailed look at your finances. Reconcile your accounts, categorize your spending, and compare it against your budget. This is also a good time to adjust your budget for the upcoming month if necessary.

Quarterly Budget Overhauls

Every quarter, conduct a thorough review of your budget. Assess your progress toward your financial goals, consider any changes in income or expenses, and make significant adjustments as needed.

| Review Frequency | Actions | Benefits |

|---|---|---|

| Weekly | Quick check of spending and income | Early detection of overspending |

| Monthly | Reconcile accounts, categorize spending | Detailed insight into financial health |

| Quarterly | Thorough budget review, adjust goals | Significant adjustments for optimal financial planning |

By incorporating these review processes into your financial routine, you can ensure that your budget remains a dynamic and effective tool for achieving your financial objectives.

Mistake 8: Excluding Partners from Financial Decisions

One of the most critical budgeting mistakes is excluding your partner from financial planning. Financial decisions can significantly impact relationships, and secrecy or exclusion can lead to mistrust and conflict.

Effective financial management in a relationship requires collaboration and transparency. When both partners are involved in financial decisions, they can Create a budget together and work towards common financial goals, strengthening their relationship and improving their financial health.

The Cost of Financial Secrecy in Relationships

Financial secrecy can have profound effects on a relationship. It can lead to feelings of betrayal and mistrust when one partner discovers that financial decisions have been made without their knowledge or input.

Consequences of financial secrecy include:

- Strained relationships due to mistrust

- Increased stress and anxiety about financial matters

- Potential for financial decisions that benefit one partner at the expense of the other

Frameworks for Productive Money Conversations

To avoid the pitfalls of financial secrecy, couples should establish a framework for discussing financial matters. This involves setting regular financial meetings and being open about financial goals, fears, and responsibilities.

Key elements of productive money conversations include:

- Regular financial check-ins

- Clear communication of financial goals and concerns

- A collaborative approach to financial decision-making

Joint vs. Separate Financial Systems

Couples often debate whether to merge their finances completely or maintain separate accounts. The best approach depends on the couple’s financial goals, spending habits, and personal preferences.

| Financial System | Advantages | Disadvantages |

|---|---|---|

| Joint Financial System | Simplifies financial management, promotes transparency | Can lead to conflicts over spending, less personal financial autonomy |

| Separate Financial Systems | Maintains personal financial autonomy, reduces conflict | Can complicate long-term financial planning, may lead to secrecy |

| Hybrid System | Balances transparency with personal autonomy | Requires careful management to avoid confusion |

Tools Designed for Couples Budgeting

There are several tools and apps designed to help couples manage their finances together. These tools can facilitate transparency, organization, and collaboration.

Some popular options include budgeting apps that allow both partners to track expenses, income, and savings goals in real-time.

By involving both partners in financial decisions and using the right tools, couples can strengthen their relationship and improve their financial stability.

Mistake 9: Relying Too Heavily on Credit

The ease of credit can sometimes lead to a dangerous dependency, jeopardizing financial stability. In an era where credit cards and loans are readily available, it’s easy to fall into the trap of relying too heavily on credit for financial needs.

Identifying Unhealthy Credit Dependencies

Unhealthy credit dependencies can manifest in various ways, including consistently relying on credit cards for daily expenses or using new loans to pay off existing debts. Recognizing these patterns is the first step towards rectifying them. Individuals should monitor their credit utilization ratio and be aware of the signs of credit dependency, such as high-interest debt and frequent loan applications.

Building a Cash Flow System That Reduces Credit Needs

A well-structured cash flow system can significantly reduce the need for credit. This involves creating a realistic budget, prioritizing needs over wants, and building an emergency fund to cover unexpected expenses. Effective cash flow management enables individuals to make informed financial decisions and avoid unnecessary credit.

Strategic Debt Reduction Plans for 2025

Implementing a strategic debt reduction plan is crucial for minimizing credit dependency. This can involve methods such as the snowball method, where smaller debts are paid off first, or the avalanche method, which prioritizes debts with the highest interest rates. Choosing the right strategy depends on individual financial circumstances and goals.

Using Credit Cards Responsibly Within Your Budget

Credit cards can be a useful financial tool when used responsibly. This means paying off the full balance each month, avoiding high-interest charges, and using credit cards for budgeted expenses only. By integrating credit card usage into a broader financial plan, individuals can reap the benefits while minimizing the risks.

By addressing the issue of credit dependency and implementing strategies to reduce it, individuals can improve their financial health and achieve greater stability in the long term.

Mistake 10: Not Planning for Major Life Changes

One of the most critical budgeting mistakes is neglecting to prepare for significant life events. Major life changes, such as career transitions, family expansions, or housing moves, can have a substantial impact on one’s financial situation.

Financial Preparations for Career Transitions

Career transitions, whether it’s switching jobs, starting a business, or entering retirement, require careful financial planning. It’s essential to anticipate potential changes in income and expenses during such transitions. Creating a contingency fund can provide a safety net during periods of unemployment or reduced income.

Budgeting Through Family Changes

Family changes, such as having children or caring for elderly parents, can significantly alter your financial landscape. It’s crucial to adjust your budget to accommodate these changes. This might involve allocating funds for childcare, education, or healthcare expenses.

Housing Moves and Their Budget Impact

Moving to a new home, whether it’s buying a larger house or downsizing, can have a substantial impact on your budget. Consider factors like mortgage payments, property taxes, and maintenance costs when planning your finances.

Creating Financial Contingency Plans

Developing a contingency plan is vital for navigating unexpected life changes. This involves identifying potential risks, such as job loss or medical emergencies, and creating strategies to mitigate their financial impact. By having a plan in place, you can ensure that you’re better prepared to handle life’s uncertainties.

By understanding the importance of planning for major life changes and implementing effective budgeting tips, you can maintain financial stability even in the face of uncertainty.

Technology Solutions to Prevent Budgeting Mistakes

As we navigate our financial lives in 2025, technology offers powerful tools to prevent budgeting mistakes. The advancement in financial technology has made it easier for individuals to manage their finances effectively.

Top Budgeting Apps and Tools for 2025

Several budgeting apps have gained popularity in 2025 for their innovative features and user-friendly interfaces. Some of the top apps include:

- Mint: Known for its comprehensive financial tracking capabilities.

- YNAB (You Need a Budget): Focuses on helping users manage their finances by assigning jobs to every dollar.

- Personal Capital: Offers a holistic view of one’s financial situation, including investments.

These apps utilize financial technology to provide real-time insights into spending habits and help users stay on top of their budgets.

Automation Features That Safeguard Your Financial Plan

Automation is a key feature in modern budgeting tools. It helps in reducing manual errors and ensures that savings and bill payments are made on time.

AI-Powered Budgeting Assistants

Some budgeting apps now incorporate AI budgeting assistants that can predict expenses and suggest adjustments based on historical data.

Integration Capabilities to Consider

When choosing a budgeting app, consider its ability to integrate with other financial services. This can enhance the overall automation of your financial management.

| Feature | Mint | YNAB | Personal Capital |

|---|---|---|---|

| Budgeting | Yes | Yes | Yes |

| Investment Tracking | No | No | Yes |

| Bill Tracking | Yes | Yes | Yes |

When to Seek Professional Financial Guidance

Understanding when to consult a financial professional can be a game-changer in achieving financial stability. As individuals navigate through various financial challenges, it’s essential to recognize the signs that indicate the need for expert guidance.

Signs Your Budgeting Challenges Require Expert Help

Several indicators suggest that your financial situation could benefit from professional advice. These include:

- Consistently failing to meet savings goals despite having a budget

- Experiencing stress related to financial decisions

- Dealing with complex financial situations such as inheritance or business ownership

- Planning for significant life events like retirement or having children

Types of Financial Professionals and Their Specialties

Different financial professionals offer specialized services. These include:

- Certified Financial Planners (CFPs): Experts in comprehensive financial planning

- Investment Advisors: Specialize in investment strategies and portfolio management

- Tax Professionals: Focus on tax planning and preparation

What to Expect from Your First Consultation

During your initial consultation with a financial professional, you can expect:

- A thorough review of your current financial situation

- Discussion of your financial goals and challenges

- An outline of the services they can offer and how they can assist you

Typical Costs and Value Assessment

The cost of hiring a financial professional varies based on their specialty, experience, and the services required. While there is a cost associated with seeking professional financial guidance, the value lies in the expertise and potentially significant long-term financial benefits.

Building a Mistake-Free Budgeting System for 2025

As we navigate the complexities of personal finance in 2025, creating a robust budgeting system is crucial for achieving financial stability and success. By understanding and avoiding the 10 common budgeting mistakes outlined in this article, individuals can significantly enhance their financial planning capabilities.

A well-structured budgeting system not only helps in tracking expenses and savings but also in setting realistic financial goals. Implementing a mistake-free budgeting approach enables individuals to make informed decisions, reduce financial stress, and improve their overall financial well-being.

To build an effective budgeting system for 2025, it’s essential to regularly review and adjust your budget, leveraging technology solutions such as budgeting apps and automation features. By doing so, individuals can stay on track with their 2025 financial goals and make adjustments as needed to stay aligned with their financial objectives.

By adopting a proactive and informed approach to financial planning, individuals can confidently navigate the financial landscape of 2025, achieving a more secure and prosperous financial future through a mistake-free budgeting system.

FAQ

What are the most common budgeting mistakes to avoid in 2025?

The most common budgeting mistakes to avoid in 2025 include not having a budget, ignoring irregular expenses, underestimating monthly expenses, setting unrealistic financial goals, and not adjusting your budget for inflation.

How can I create an effective budget framework?

To create an effective budget framework, start by tracking your expenses, identifying your financial goals, and categorizing your expenses. You can use digital tools like budgeting apps or traditional methods like pen-and-paper systems to set up your budget.

What is a sinking fund, and how does it work?

A sinking fund is a separate savings account used to accumulate money for irregular expenses, such as annual or quarterly expenses. By calculating the right monthly contributions and keeping the funds separate, you can avoid going into debt when these expenses arise.

How can I inflation-proof my spending plan?

To inflation-proof your spending plan, stay informed about inflation projections, adjust your budget accordingly, and consider using price-tracking tools to make smart shopping decisions. You may also need to adjust your income to counter rising costs.

What is the “pay yourself first” principle, and how can I implement it?

The “pay yourself first” principle involves prioritizing savings and investments by setting aside a portion of your income before spending on other things. You can implement this by automating your savings and investments through direct deposits or transfers.

How often should I review and adjust my budget?

It’s essential to regularly review and adjust your budget to ensure it remains effective. Consider weekly quick checks, monthly reconciliation, and quarterly budget overhauls to stay on track and make necessary adjustments.

What are some signs that I need to seek professional financial guidance?

Signs that you may need professional financial guidance include feeling overwhelmed by your financial situation, struggling to create a budget that works, or facing complex financial decisions, such as planning for retirement or managing debt.

How can technology help me prevent budgeting mistakes?

Technology can help prevent budgeting mistakes by providing tools like budgeting apps, automation features, and AI-powered budgeting assistants. These solutions can help you track expenses, stay on top of financial goals, and make informed financial decisions.

What are some effective strategies for reducing debt and using credit responsibly?

To reduce debt and use credit responsibly, consider creating a strategic debt reduction plan, building a cash flow system that minimizes credit needs, and using credit cards within your budget. Avoid relying too heavily on credit and focus on making timely payments.

How can I plan for major life changes, such as career transitions or family changes?

To plan for major life changes, anticipate the financial impact, and create contingency plans. This may involve adjusting your budget, building an emergency fund, and exploring financial resources available to support you during the transition.